As anticipation builds for the October 8 release of a documentary exploring the identity of Bitcoin's creator, Satoshi Nakamoto, a notable transfer has caught the attention of cryptocurrency enthusiasts. A Bitcoin whale recently moved $3.6 million worth of Bitcoin (BTC) to the Kraken exchange, reigniting speculation about Nakamoto’s identity.

Whale’s History with Bitcoin

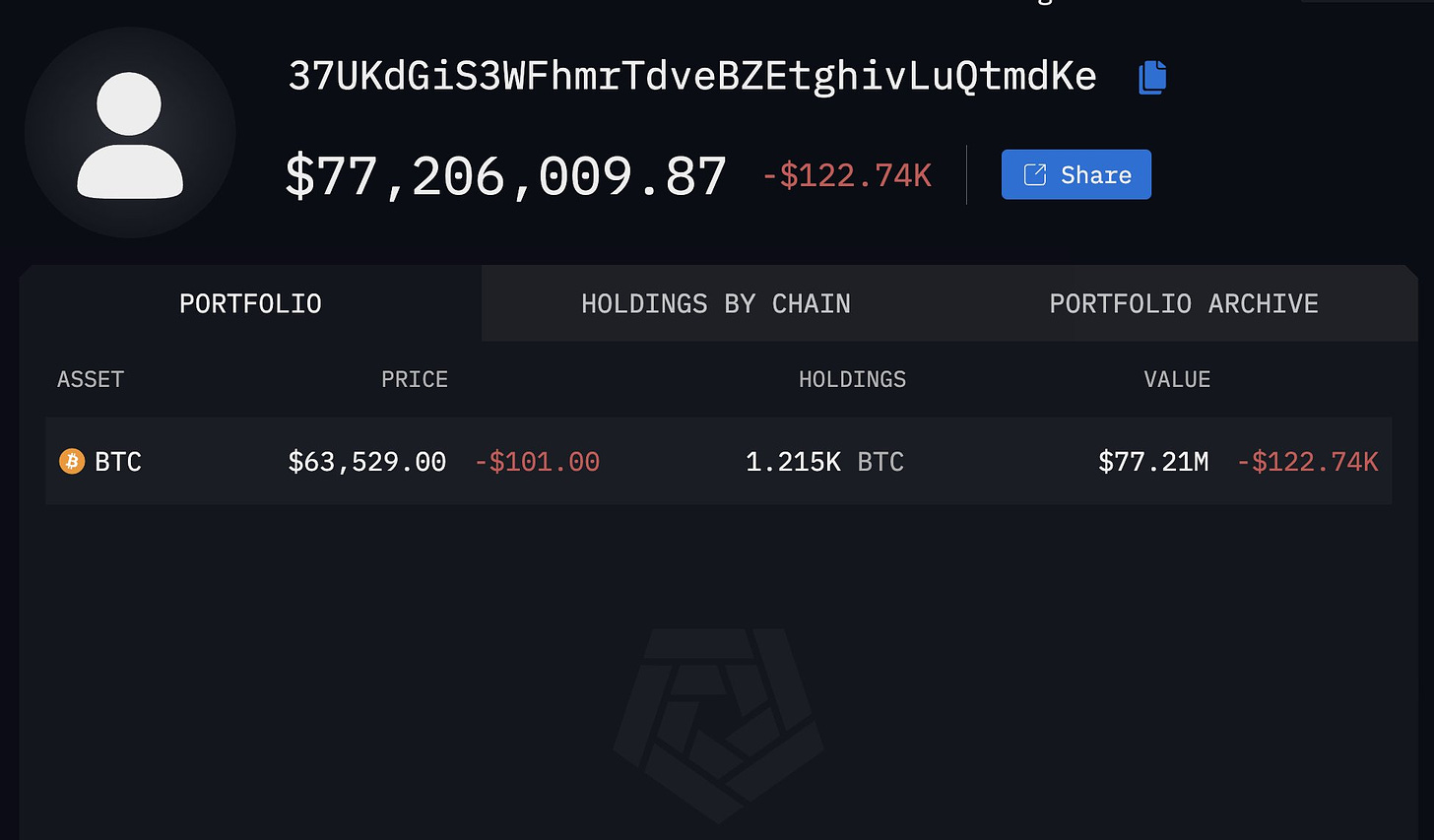

Blockchain analytics firm Arkham Intelligence reports that this whale has been holding Bitcoin since 2009. They transferred 221 BTC, valued at approximately $3.58 million, making these coins some of the oldest in existence.

This isn’t the whale’s first movement this year; a transfer of five BTC to Kraken was recorded on September 24. Currently, the whale holds about 1,215 BTC, worth over $72.5 million. Given the whale's early involvement, many speculate they could be related to early investors or even Nakamoto.

Market Reaction to Economic Data

On October 4, 2024, Bitcoin was trading at $62,376 as per Coinpedia markets data, buoyed by positive U.S. economic data. The latest non-farm payroll report indicated an increase of 254,000 jobs in September, far surpassing expectations of 147,000. This stronger-than-anticipated data has improved market sentiment and heightened hopes for a potential interest rate cut by the Federal Reserve in November.

In addition to favorable economic indicators, Bitcoin’s on-chain metrics show that the amount of BTC held on exchanges is at its lowest in six years, with roughly 2.8 million BTC. This drop in exchange-held Bitcoin is considered bullish, as reduced liquidity typically puts upward pressure on prices.

The Documentary’s Impact

Directed by Cullen Hoback, known for his work in “Q: Into the Storm,” the upcoming HBO film seeks to uncover the origins of Bitcoin and may reveal Nakamoto’s identity. Speculation has focused on Len Sassaman, a cryptographer who died in 2011 shortly after Nakamoto’s last public communications.

A prediction platform, Polymarket, indicates that 51% of users believe the documentary will point to Sassaman as the potential creator of Bitcoin, making him the leading candidate in current discussions.

Rising Institutional Interest

Source; CryptoQuant

Amid these developments, institutional demand for Bitcoin is on the rise, particularly through U.S.-based spot Bitcoin ETFs. Data from CryptoQuant shows that institutional investors, who were net sellers in September, have reversed course and are now purchasing around 7,000 BTC daily. This marks the highest daily purchase rate since July, reflecting growing institutional confidence in Bitcoin’s long-term prospects.

With decreasing Bitcoin reserves on exchanges and a surge in institutional interest, market analysts are optimistic about Bitcoin's potential for new all-time highs as 2024 unfolds. As the documentary on Nakamoto approaches, the intertwining of speculation and market dynamics could lead to intriguing developments in the world of Bitcoin.

For a deeper dive into Bitcoin price prediction and what this might mean for investors, be sure to check out our detailed analysis.

Also Read

$260M in Ethereum Sent to Exchanges, Market Crash Ahead?

XRP Price Rally Mirrors 2016-17, Analyst Sees Opportunity Amid SEC Appeal

Grayscale Investment Launches Aave Trust, Driving AAVE Price Surge

EigenLayer Price Spikes Despite $5.5M Token Sale Scandal and Justin Sun’s Sell-off

Any Feedback?

Get in touch with us here