On August 5, the Crypto Fear and Greed Index recorded a score of 17 out of 100, the lowest since July 12, 2022. This marked the first time in two years that the index fell into the “Extreme Fear” zone, driven by significant outflows in Bitcoin exchange-traded funds (ETFs).

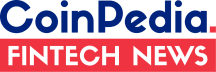

Major Outflows in Bitcoin ETFs

On August 5, spot Bitcoin ETFs reported $168.4 million in outflows. The Grayscale Bitcoin Trust and the ARK 21Shares Bitcoin ETF saw the largest outflows, at $69.1 million and $69 million respectively. Despite this, the Grayscale Bitcoin Mini Trust, VanEck Bitcoin ETF, and Bitwise Bitcoin ETF recorded inflows of $21.8 million, $3 million, and $2.9 million respectively. Meanwhile, BlackRock’s iShares Bitcoin Trust recorded no inflows.

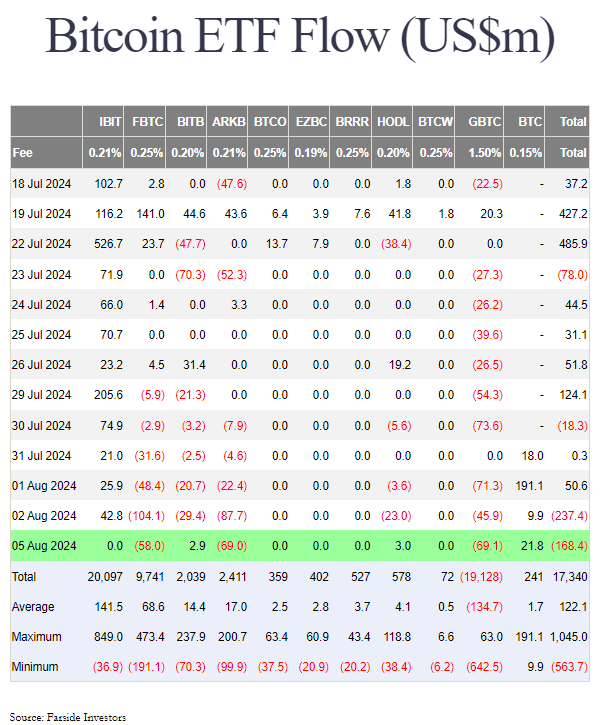

Ether ETFs Show Positive Inflows

In contrast to Bitcoin, spot Ether (ETH) ETFs saw a $48.8 million inflow. The iShares Ethereum Trust led with $47.1 million, followed by VanEck and Fidelity’s Ether products, which recorded $16.6 million and $16.2 million respectively.

Market Turbulence on August 5

The decline in sentiment came as Bitcoin and Ether prices dropped 10% and 18% respectively within a two-hour window on August 5. This led to the liquidation of over $600 million in leveraged long positions, significantly affecting altcoins more than Bitcoin and Ether.

Additionally, trillions of dollars were wiped from the US stock market, influenced by weak employment data, slowed growth among major tech stocks, and revived fears of a recession.

Significant Market Event

Independent trader Bob Loukas described the recent market events as a once-in-7-to-10-year occurrence, noting that more than $500 billion was erased from the crypto market cap.

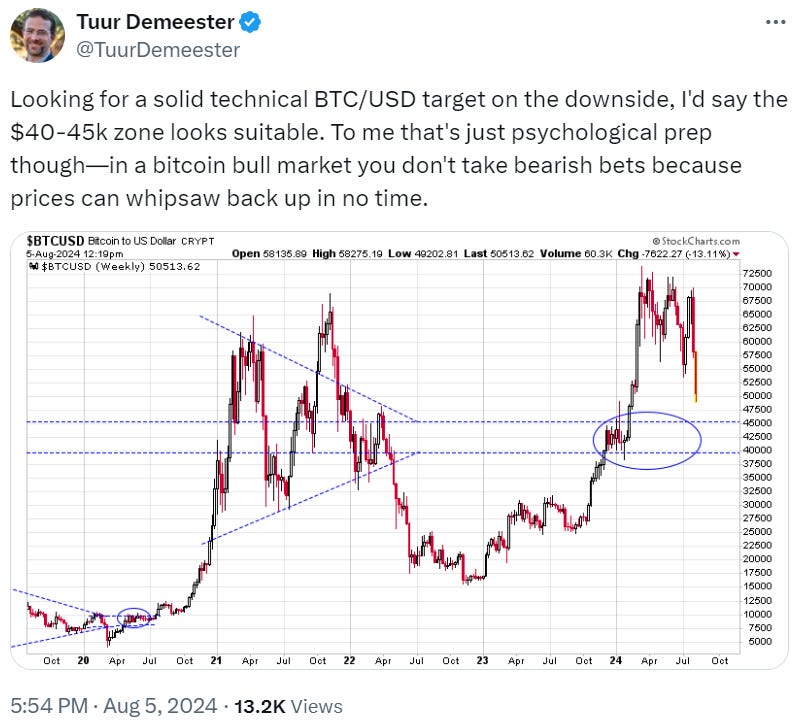

Bitcoin analyst Tuur Demeester suggested that Bitcoin could bottom between $40,000 and $45,000 but advised caution in making bearish bets during a Bitcoin bull market due to potential rapid price recoveries.

Bitcoin's Partial Recovery

Since bottoming out at $49,780 on August 5, Bitcoin has partially recovered, rising 11.85% to $55,680, according to Coinpedia Markets data.

The recent market turbulence highlights the volatility and risks inherent in cryptocurrency investments, emphasizing the importance of cautious and informed trading strategies.

Any Feedback?

Get in touch with us here