Bitcoin starts the new year with an exhilarating surge, hitting a record high of 64K on February 28th. However, 2024 isn't your average year; it's packed with significant events that have set the market abuzz with excitement.

Amidst a flurry of bold projections from analysts, some have gone as far as forecasting Bitcoin to skyrocket to $150,000 by the year's end. But what's fueling this fervor? What's behind these optimistic predictions? Let's delve into the reasons driving the bullish forecasts.

Bitcoin ETF: SEC approves 11 Bitcoin ETFs, reshaping crypto regulation, potentially attracting billions from institutional investors.

Bitcoin Halving Event: Occurs every 4 years, historically propelling Bitcoin to new highs, anticipates tripling value in 2024.

US Presidential Election: Pro-Bitcoin candidates Biden, Trump, Kennedy may influence crypto markets.

Fed Rate Cut : Expected inflation rate reduction in 2024 may positively impact Bitcoin prices amid monetary policy changes.

Bitcoin ETFs are gaining momentum, with the US SEC recently approving approximately 11 Bitcoin Spot ETFs, including offerings from BlockRock, Fidelity, and Invesco.

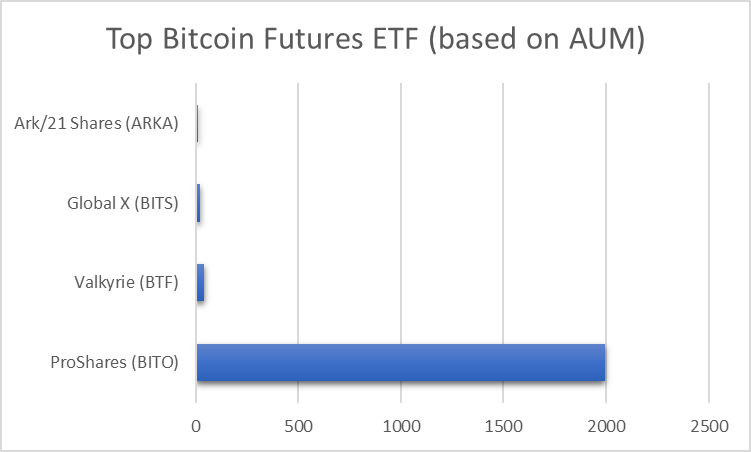

As of writing, ProShare, Valkyrie, Global X, and Ark/21 Shares lead the Bitcoin Futures ETF market by Asset Under Management.

In this report, we analyze Bitcoin ETF performance this month using top data sources. Our focus extends to Bitcoin Futures ETFs. Join us as we explore performance trends, offering a detailed look at Bitcoin ETFs in the market.

Research Reports

The NFT Report: February 2024’s Market Trends and Top Projects

Blockchain February 2024 Report: A Deep Dive into Development, Stability, & User Interest

Crypto Market Monthly Report: 50% Surge Promises A March Madness

DeFi Report 2024: A Deep Dive into February’s Top Performers

Any Feedback?

Get in touch with us here