Dear Readers,

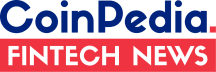

Bitcoin took investors by surprise today as it saw a significant downturn in its value. Despite this 10% drop in price during the day, metrics from derivatives markets still indicate a neutral-to-bearish sentiment.

Source: Coinpedia Markets

The price of Bitcoin (BTC) took a tumble, experiencing a 10% correction and falling to $61,931 after hitting an all-time high of $69,150 on March 5th. Now, the focus shifts to the critical support level of $64,000, which Bitcoin must reclaim. Despite the short-term volatility witnessed today, data from BTC derivatives markets suggests that professional traders are maintaining a slightly bullish outlook.

Source: Coinmarketcap

The Reasons Behind Bitcoin Price Crash

Bitcoin's correction occurred alongside a 2.6% retracement in the Nasdaq-100 index futures, which recently reached an all-time high of 18,377 on March 4.

The stock market showed early signs of stress following reports indicating a 24% decline in Apple iPhone sales in China, as estimated by a consumer research firm.

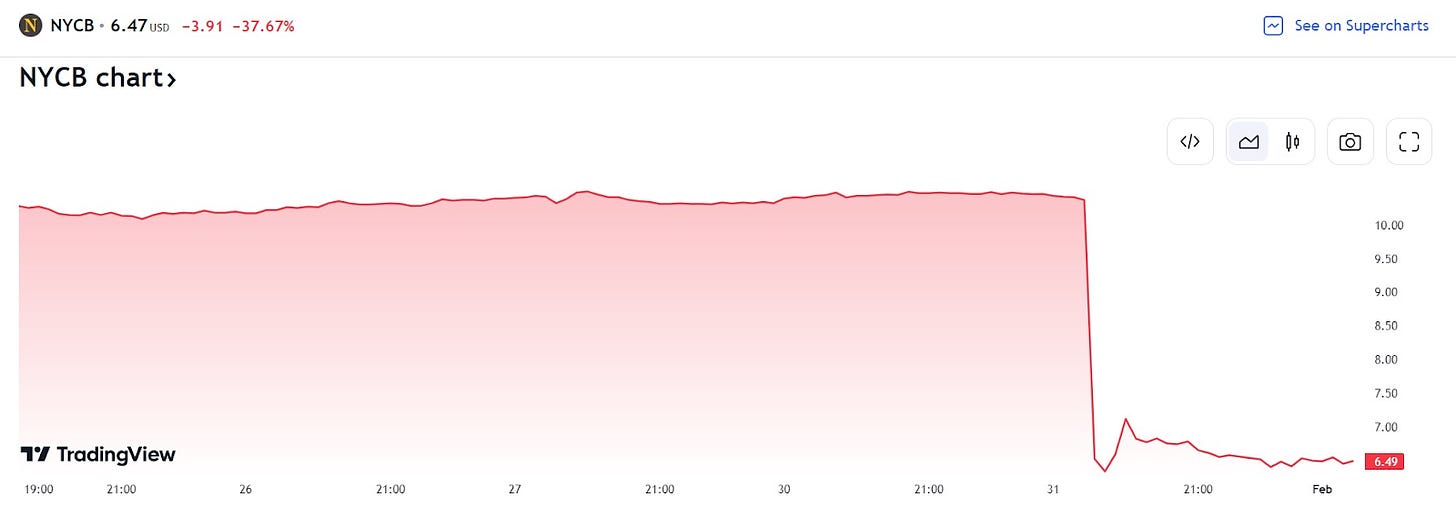

NYCB shares dropped 40% after releasing its quarterly report.

Source: TradingView

New York Community Bancorp (NYCB) experienced continued declines in its shares after the company replaced its CEO due to reported "material weaknesses" in internal controls.

Investors turned to gold as a safe haven, with the precious metal gaining 4.2% in four days and currently trading near its all-time high.

The recent surge in Bitcoin's price attracted media attention, potentially prompting large investors (whales) to consider shorting the cryptocurrency or encouraging holders to reduce their positions amidst skepticism from Bitcoin critics.

The funding rate on Bitcoin perpetual contracts exceeded 1% per week on Feb. 28, drawing attention. However, this metric has consistently reflected investors' optimism over the past few months, as highlighted by user @bitcoinmunger on X social network.

Discover the Factors Influencing the Bitcoin Price Decline, and How This Time Might Be Different. Learn More on Coinpedia for Detailed Insights.

Also Read

Why did the Crypto Market Crash? What Next For Bitcoin and Altcoin?

Bitcoin soared to $69,324 but plummeted by 10%, triggering a $1B sell-off. Analysts foresee altcoins overtaking Bitcoin dominance amid volatility.

Bitcoin's resurgence discussed by Anthony Pompliano cites ETF approvals and institutional investments, foreseeing rapid growth, institutional involvement, and surpassing gold.

Top Meme Coins That Will Make You Millionaire This Bull Market

Bitcoin's surge to $65,000 sparks altcoin frenzy; expert predicts $200,000 by 2025. Meme coins like Pepe and Bonk see massive gains. DeFi platforms and Solana's Clone Protocol gain traction.

Bitcoin's ascent prompts meme coin surge, with Dogecoin and Shiba Inu leading. On-chain metrics signal bullish momentum, despite recent corrections.

Bitcoin Price Prediction 2024 : BTC Price Hits ATH; Here’s How High it Could Surge This Year

Analyst predicts Bitcoin could hit $200,000 by 2024 due to increasing demand, halving event, and institutional investments. Excitement rises.

Any Feedback?

Get in touch with us here