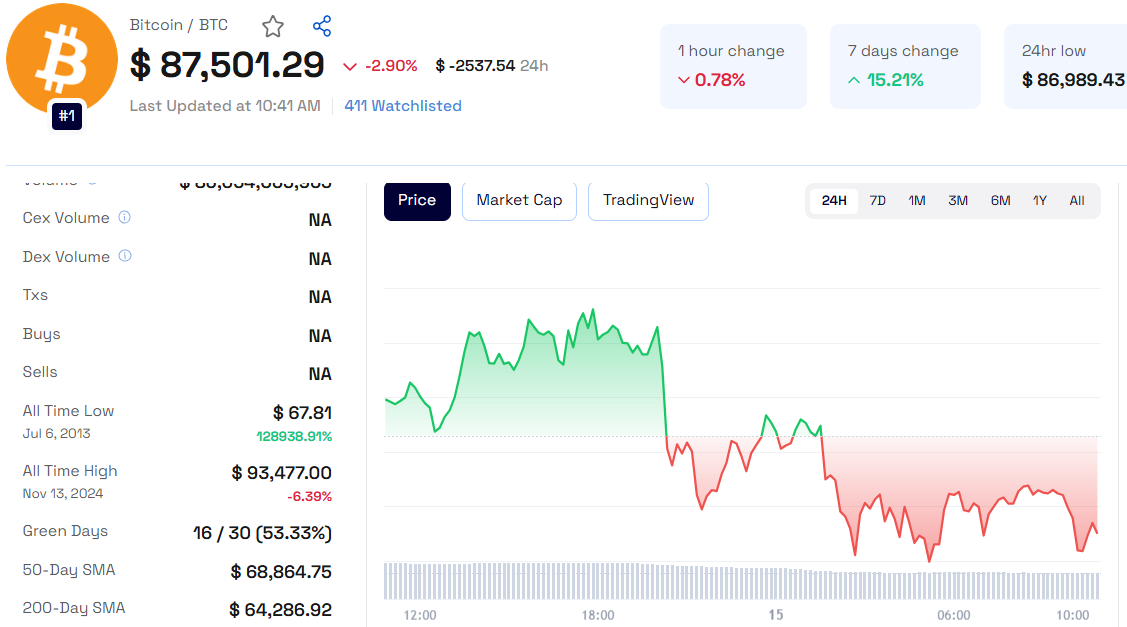

Bitcoin’s price recently dropped nearly 3% after Federal Reserve Chair Jerome Powell hinted that further interest rate cuts in December are unlikely. This has left investors wondering about Bitcoin’s short-term price outlook and its long-term potential.

Currently trading at $87,501.29 with 3% dip in last 24 hours as per Coinpedia Markets data.

Here’s a look at what’s happening now and what the future holds for Bitcoin, especially with the Bitcoin Price Prediction 2030.

Bitcoin Price Drops After Powell’s Comments

On November 14, 2024, Bitcoin fell to $86,979 after Jerome Powell stated there was no rush to cut interest rates. This came after two recent rate cuts in September and November. The price quickly recovered to around $88,100, but the initial drop highlighted how sensitive Bitcoin is to economic signals.

Why Interest Rates Matter for Bitcoin

Bitcoin investors closely watch interest rates because lower rates tend to make traditional investments like bonds less attractive, encouraging investors to seek higher returns from riskier assets like Bitcoin. Powell’s comment suggested that rate cuts may not continue, which could dampen investor optimism for Bitcoin in the short term.

Inflation Data and Its Impact

On the same day, the U.S. Producer Price Index (PPI) showed a 2.4% annual increase, slightly above the expected 2.3%. While this inflation data was close to forecasts, it reduced the urgency for the Fed to adjust rates further.

Higher inflation could make Bitcoin more appealing as a hedge, but with the Fed holding back on rate cuts, Bitcoin’s price may not see the same spikes as in the past.

Bitcoin Price Prediction 2030: What’s Ahead?

Looking towards 2030, Bitcoin’s future price is influenced by several factors:

Regulation: How governments regulate Bitcoin will play a big role in its long-term growth.

Institutional Adoption: More institutional investment could push Bitcoin to new highs.

Technology Improvements: Upgrades to Bitcoin’s network could increase its appeal.

Some analysts predict Bitcoin could reach $100,000 to $500,000 per BTC by 2030, depending on adoption and market conditions.

The recent dip in Bitcoin’s price highlights the impact of economic shifts, especially interest rates. While short-term fluctuations are common, the long-term outlook for Bitcoin remains positive. Keep an eye on key factors like interest rates, inflation, and institutional interest to understand where Bitcoin’s price is headed in the coming years.

Also Read

Crypto vs SEC : 18 States Join Forces Against SEC Crypto Regulations

Why Ethereum is Dropping Today?

Is Gary Gensler Resigning? SEC Chair Hints at Exit Amid Crypto Regulatory Shift

Gensler’s Potential Exit Fuels XRP’s Breakout, 75% Rally Incoming

Donald Trump’s Plan to Eliminate Capital Gains Tax on U.S. Cryptocurrencies

Any Feedback?

Get in touch with us here