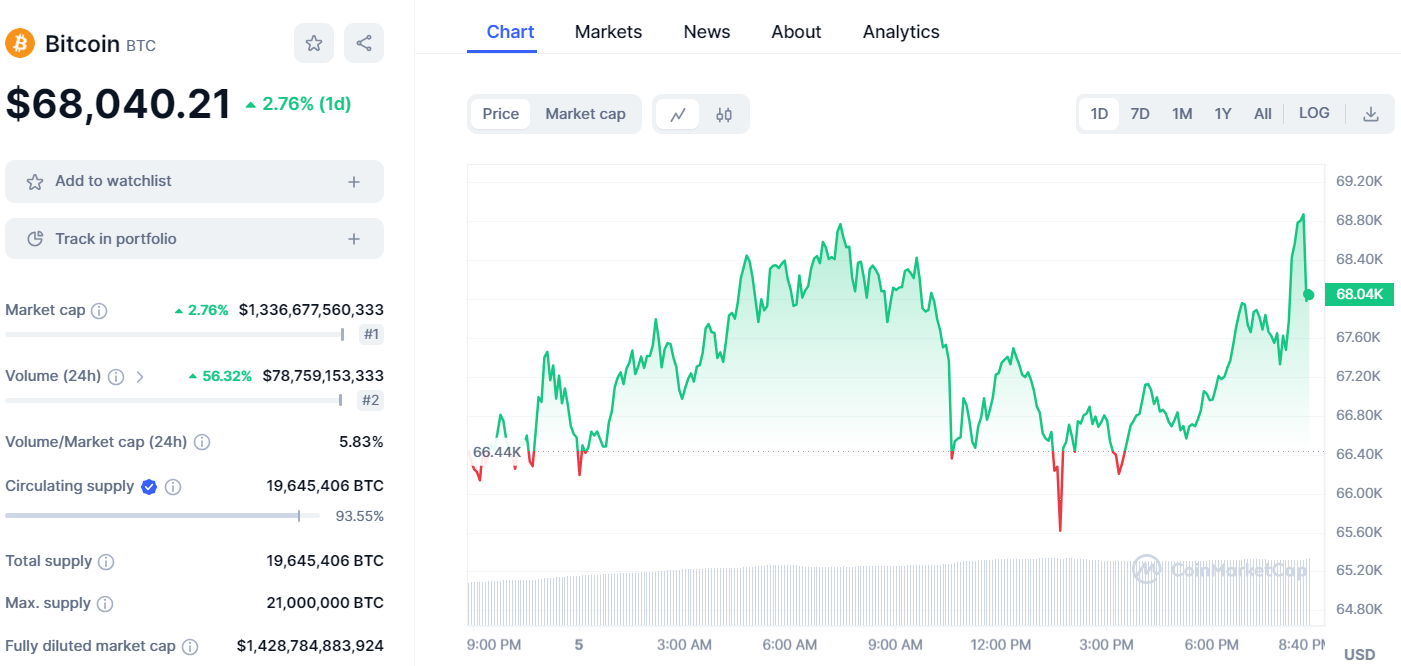

In a historic surge, the price of Bitcoin (BTC) has soared past $69,200, marking a significant milestone. This surge, gaining 5% in the past 24 hours alone, has captivated investors and analysts. Let's delve into the factors contributing to this rally and what lies ahead for the world's first cryptocurrency.

Breaking Records: Bitcoin's Remarkable Climb

Bitcoin's recent rally has been impressive, with the cryptocurrency gaining over 21% in just one week. Surpassing its previous all-time high of $68,990 set in November 2021, Bitcoin's upward trajectory has been fueled by factors.

Spot ETFs: Fueling Demand and Price Appreciation

A significant catalyst for Bitcoin's surge has been the introduction of spot Bitcoin exchange-traded funds (ETFs) in the United States. These ETFs have brought substantial inflows, introducing passive demand for Bitcoin and reinforcing its status as a store of value.

According to analysts at Bitfinex, this influx of institutional investment is expected to drive Bitcoin's price even higher. Their research report forecasts a conservative price objective of $100,000-$120,000 to be achieved by the fourth quarter of 2024, with the cycle peak anticipated in 2025.

Stability Amidst Volatility: Impact of Bitcoin ETFs

The introduction of Bitcoin ETFs is boosting demand and potentially mitigating downside volatility. Analysts suggest that the presence of these ETFs could lead to a more stable trajectory for Bitcoin's price movements, similar to gold ETFs.

As Bitcoin ETFs continue to gain traction, they are poised to overtake gold ETFs in assets under management within the next two years. This trend underscores the growing institutional interest in Bitcoin as a viable investment asset.

Challenges Ahead: Navigating Volatility and Supply Dynamics

Despite the optimism surrounding Bitcoin's rally, challenges lie ahead, particularly concerning volatility and supply dynamics. Paul Eisma, head of options trading at XBTO Futures, highlights the potential impact of Bitcoin's halving event, which reduces the rate at which new Bitcoins are created.

Eisma warns of simultaneous pressure from the halving's deflationary supply impact and ongoing demand shocks from ETFs. This combination could contribute to significant volatility in the cryptocurrency market, with implied volatility levels indicating a range of $55,000-$85,000 by December 2024.

As Bitcoin continues its upward trajectory, breaking through new all-time highs, its journey towards mainstream adoption is becoming increasingly evident. The introduction of ETFs, institutional investment, and growing recognition as a store of value signal a transformative phase for the cryptocurrency.

However, amidst the excitement, it's crucial to remain mindful of potential challenges and volatility inherent in the cryptocurrency market. Navigating these dynamics will be key as Bitcoin aims to solidify its position as a prominent asset class in the global financial landscape.

Any Feedback?

Get in touch with us here