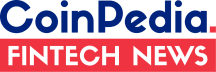

Bitcoin has reached a new all-time high (ATH) of $80,000 as of November 10, 2024, raising questions about its future direction. While the milestone is impressive, many are wondering if the price will continue to rise or if a correction is on the horizon.

For a deeper dive into Bitcoin Price Prediction and market trends, check out our detailed analysis.

Bitcoin’s Surge to $80,000

Bitcoin’s rise to $80,000 has pushed 100% of wallet addresses into profit, according to CryptoQuant’s Ki Young Ju. While this is a significant achievement, historical trends suggest that such levels often lead to price corrections as investors look to take profits.

Bitcoin is now in a “price discovery” phase, where future price movement is uncertain. While this creates opportunities, it also raises concerns about volatility.

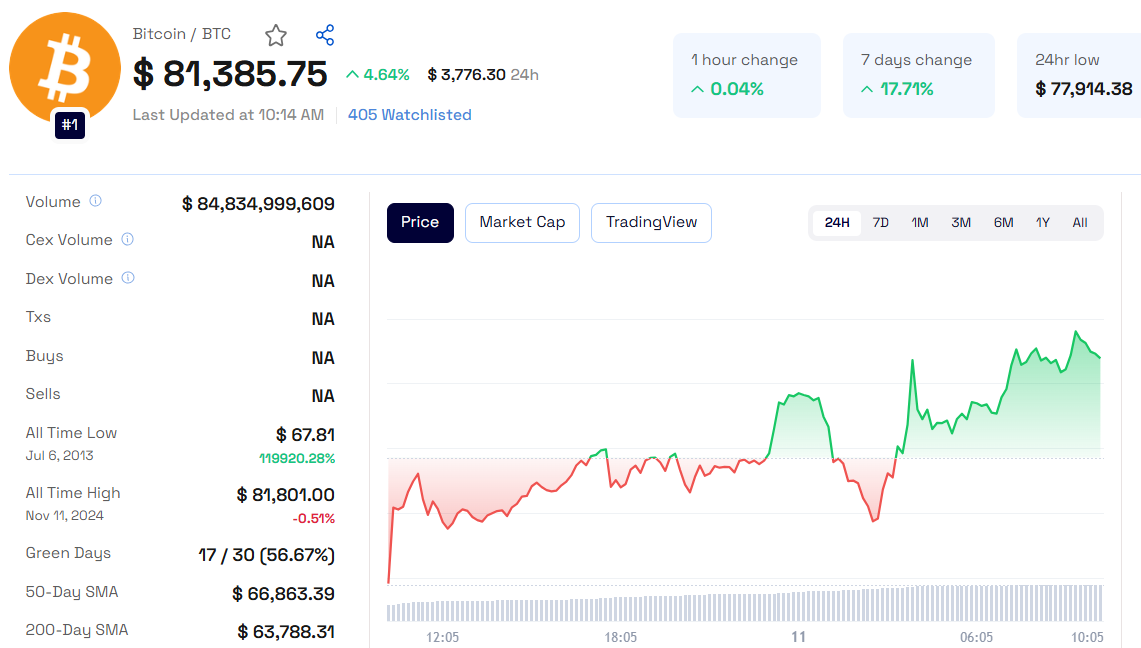

Extreme Greed Signals Potential Pullback

The Bitcoin Fear and Greed Index is currently at 76, indicating “Extreme Greed.” Historically, this level of market sentiment often precedes price pullbacks as overbought conditions lead to selling pressure. If the bullish sentiment continues, a correction could be coming soon as investors secure profits.

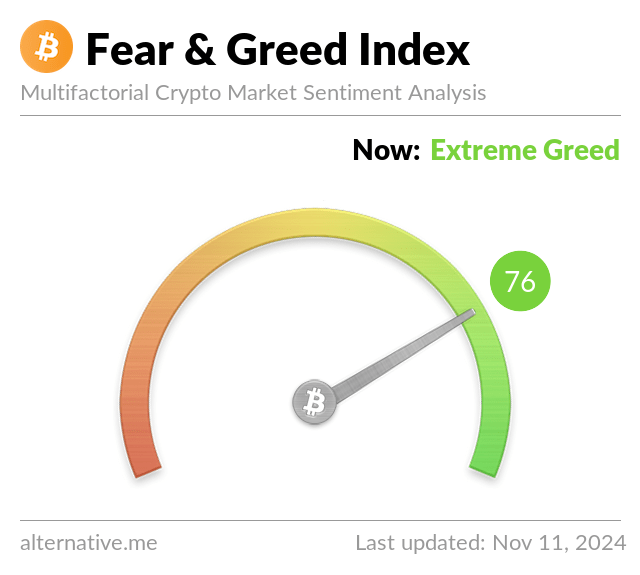

Market Activity: High Volume and Open Interest

Trading volume has surged by 33.31%, reaching $78.12 billion, and open interest has increased by 4.16%, now sitting at $48.78 billion. This suggests strong market engagement and new money entering the market. However, high volume and open interest can also signal increased volatility, as large players may capitalize on momentum.

Key Support and Resistance Levels

As Bitcoin approaches $80,000, technical analysts are eyeing key levels:

Support:

$75,000 to $76,000: This range could act as a foundation if Bitcoin retraces.

$70,000 to $72,000: This area, where Bitcoin previously consolidated, could offer additional support.

Resistance:

$80,500: The immediate resistance level. A break above could lead to further gains.

$82,000 to $85,000: These levels represent key resistance zones. Breaking them could fuel a continued rally, but selling pressure may arise.

Key Events to Watch

Several upcoming events could impact Bitcoin’s price:

October CPI Inflation Data (Tuesday): This could influence Bitcoin's role as an inflation hedge.

October PPI Inflation Data (Thursday): The Producer Price Index (PPI) report could affect market sentiment.

Fed Chair Jerome Powell Speaks (Thursday): Any comments on interest rates or monetary policy could influence Bitcoin's price.

Will Bitcoin Keep Rising?

Bitcoin’s rise to $80,000 is notable, but a correction may be near due to high greed levels, rising open interest, and key resistance points. If Bitcoin breaks through resistance levels, $100,000 could be the next target. However, traders should remain cautious, as the crypto market remains volatile.

Bitcoin’s climb to $80,000 has been impressive, but market signals suggest a potential pullback. With "Extreme Greed" in play and key support and resistance levels in focus, Bitcoin’s next move remains uncertain. Keep an eye on upcoming economic data and price levels for further clues on its direction.

Also Read

What Happened In The Crypto Market This Week?

Pendle Team Moves Over 2M Tokens Worth $11M to Binance

Breakout Alert! Dogecoin (DOGE) Could Soar by 50%, Key Insights

Shiba Inu (SHIB) Flashes Buy Signal, Key Insights for Traders

Hamster Kombat Surges By 60%, DWF Labs Withdraws 156M HMSTR

Any Feedback?

Get in touch with us here