BlackRock, the world’s largest asset manager, has reached a major milestone with its Bitcoin exchange-traded fund (ETF), surpassing $1 billion in inflows for the first time since its launch. This comes as Bitcoin continues its impressive rally, setting new all-time highs in early November.

Record Inflows for BlackRock's Bitcoin ETF

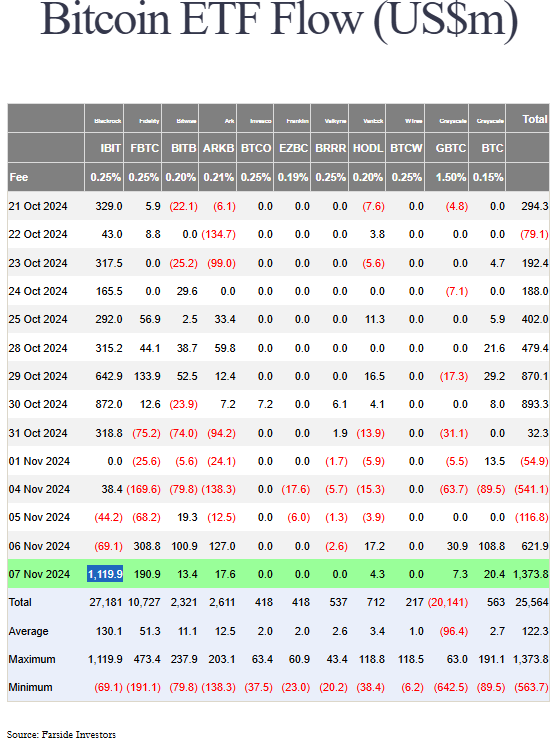

On November 7, BlackRock’s spot Bitcoin ETF (IBIT) saw $1.1 billion in inflows, marking a significant rebound after two days of outflows totaling $113.3 million, according to Farside data. IBIT captured 82% of the total inflows across all U.S.-listed Bitcoin ETFs that day, which amounted to $1.34 billion.

Bitcoin Hits Nearly $77K

The surge in IBIT inflows coincided with Bitcoin reaching $76,943, setting a new all-time high, according to Coinpedia Markets. The rising price of Bitcoin is driving increased interest from institutional investors, contributing to the ETF’s record performance.

For a deeper dive into Bitcoin Price Prediction and market trends, check out our detailed analysis.

Other Bitcoin ETFs See Strong Inflows

While BlackRock’s IBIT led the way, other Bitcoin ETFs also experienced notable inflows. The Fidelity Wise Origin Bitcoin Fund (FBTC) saw $190.9 million in inflows, followed by the ARK 21Shares Bitcoin ETF (ARKB) with $17.6 million. In total, U.S.-listed spot Bitcoin ETFs saw $1.34 billion in inflows on November 7.

More Big Moves Expected

Market experts believe there could be more large inflows in the days ahead. Crypto trader "The Bitcoin Therapist" predicted another massive inflow day, while financial analyst Rajat Soni urged investors to "buckle up." Crypto commentator Zia ul Haque referred to it as "PumpVember," hinting at more volatility in the coming weeks.

Surprising Volume Surge

Bloomberg ETF analyst Eric Balchunas was surprised by the scale of the inflows, even though he had anticipated strong numbers based on previous trading volumes. Balchunas highlighted that IBIT saw nearly $1.1 billion in trading volume within the first 20 minutes of market open on November 6, following the U.S. presidential election.

What’s Driving the Growth?

The increase in inflows is driven by Bitcoin’s rising price and growing institutional interest. The expectation of favorable regulatory developments for Bitcoin is also fueling investor optimism and driving more funds into the space.

A Turning Point for Bitcoin ETFs?

The record inflows into BlackRock’s spot Bitcoin ETF mark a significant moment for the cryptocurrency market. As institutional interest in Bitcoin grows, the future looks promising for Bitcoin ETFs.

Also Read

Ripple Vs SEC Fight Finally End in 2024? Attorney Jeremy Hogan Thinks So!

Dean Skurka, CEO of Crypto Company WonderFi, Kidnapped in Toronto

Chainlink (LINK) Analysis, Traders Eyes on $15

Ethereum’s Bullish Breakout, ETH Poised for 23% Rally

Federal Reserve Slashes Interest Rates by 25 Basis Points, Sending Bitcoin Price Towards New ATH

Any Feedback?

Get in touch with us here