Recent geopolitical events have triggered a significant drop in the cryptocurrency market. Following Israel's military strikes on Iranian targets, Bitcoin (BTC) fell 2%, while several altcoins—including Ethereum (ETH), Solana (SOL), and Binance Coin (BNB)—suffered losses ranging from 3% to 6%. Analysts warn of a potential further decline in altcoin values in the coming months.

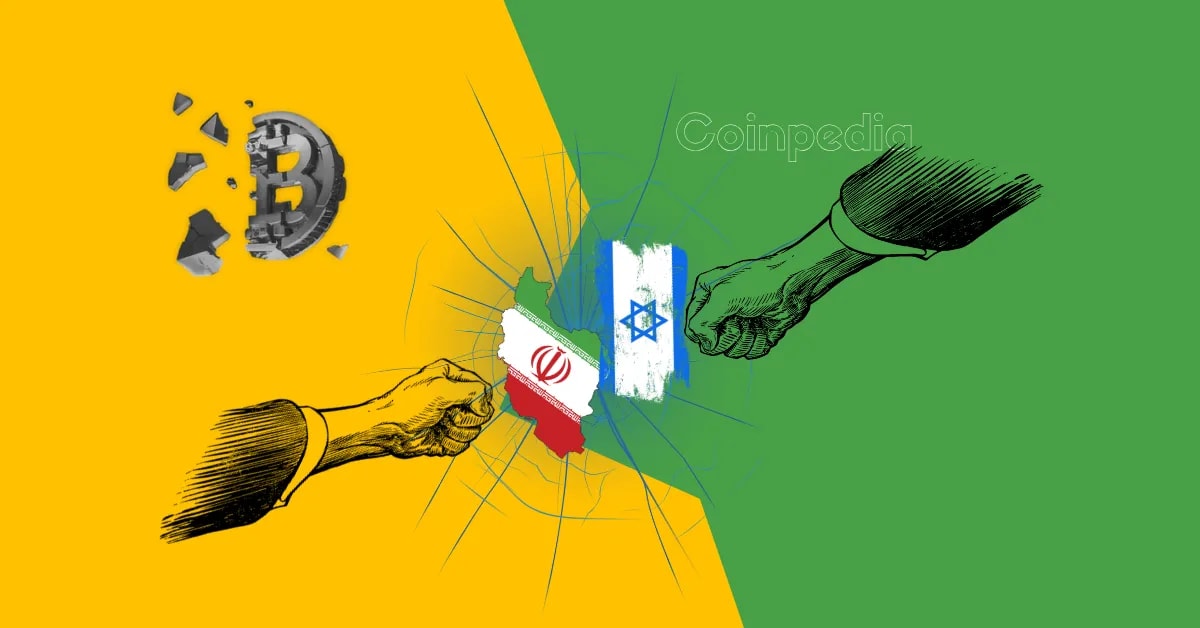

As of writing this article Bitcoin was trading at $ 66,864.11 with 2% decline in last 24 hours as per Coinpedia markets data.

For a deeper dive into the future of Bitcoin, check out our detailed Bitcoin price prediction article!

Geopolitical Tensions Affecting Prices

On Saturday, Israel conducted strikes on Iranian military bases, escalating tensions in the Middle East. Reports of explosions in Tehran contributed to a ripple effect across global markets, particularly affecting cryptocurrencies.

This is not the first time geopolitical unrest has influenced Bitcoin prices. In April, a similar incident resulted in a more than 4% drop in Bitcoin’s value, although it recovered quickly.

While analysts anticipate that the current downturn may also be short-lived, the impact on altcoins has been more pronounced.

Altcoin Performance

Ethereum’s price fell about 3% to around $2,450, bringing its weekly losses to over 7.68%. Solana’s value dipped by 6.3%, falling below $165. Despite recent gains of 11% for Solana, the latest developments have erased some of those profits.

Analyst Benjamin Cowen noted the struggles of altcoins, mentioning that the ALT/BTC pair reached a new low today, signaling continued challenges for altcoin investors.

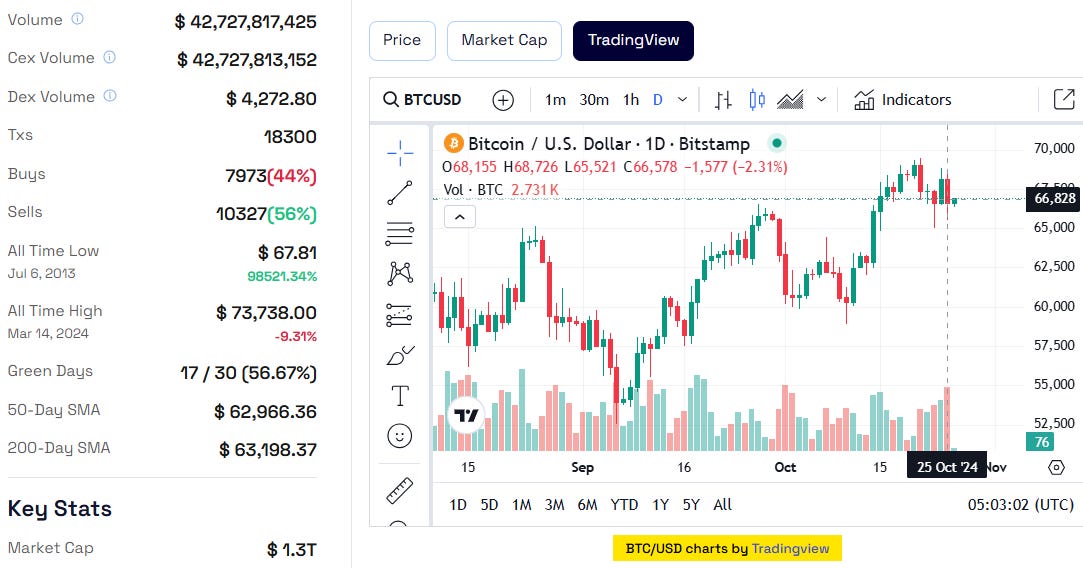

Concerns Surrounding Tether

Adding to the market’s woes are concerns about Tether (USDT). Reports have emerged of a U.S. Department of Justice investigation into the stablecoin, raising alarms among traders. Tether's management dismissed these allegations, but the news has affected its stability, with USDT trading at about $0.9983—slightly below its expected value.

Tether is critical in the crypto market, boasting a market cap of $120 billion. Experts like Hilary Allen, a law professor specializing in digital assets, warn that Tether is "too big to fail." A collapse could have severe effects on the entire crypto economy.

Conversely, Jeff Dorman, CIO of Arca, suggests that the market may have become desensitized to regulatory concerns. He believes it will take time to assess whether the investigation will have lasting repercussions.

The combination of geopolitical tensions and concerns over Tether has created a perfect storm for the cryptocurrency market, leading to declines in both Bitcoin and altcoins. While some analysts predict a recovery, the short-term outlook remains uncertain as traders navigate these turbulent waters.

Also Read

Ripple News: CEO Shares Views on Why SEC Shouldn’t Prevail

Ethereum Whale Dumps $23 Million of ETH as Price Sinks

Shiba Inu Flashes Sell-Off Signal, Price Poised for 15% Drop

Trader Makes $140K in Just 20 Minutes, Here’s How

Any Feedback?

Get in touch with us here