Crypto Stocks and Bitcoin Ride Trump’s Win to Gains!

Is Bitcoin Price Poised for More Record-High Prices?

The crypto market saw a surge in stock prices on November 6, driven by Donald Trump’s election win and Bitcoin reaching a new all-time high. Key crypto-related stocks, including Coinbase Global Inc. (COIN), Robinhood Markets Inc. (HOOD), and several Bitcoin miners, experienced significant gains. Here’s a closer look at what’s behind this rally and what it means for Bitcoin and crypto regulation in the U.S.

Coinbase and Robinhood See Major Gains

Coinbase, one of the world’s largest cryptocurrency exchanges, saw its stock jump 31.11% on November 6, closing at $254.30. This marked a 62.1% increase for the year. The surge was driven by the optimism surrounding Trump’s victory and Bitcoin’s strong performance.

COIN surged over Nov. 6 on Trump’s win

Robinhood, the popular retail trading platform, also saw a 19.6% increase in its stock price. Similarly, Bitcoin miner MARA Holdings Inc. (formerly Marathon Digital) rose 19.6%, and MicroStrategy Inc. (MSTR), a major Bitcoin buyer, gained over 13%.

Bitcoin Miners and Other Crypto Stocks Rise

Several Bitcoin mining companies also saw impressive gains. Riot Platforms Inc. (RIOT) surged 26%, CleanSpark Inc. (CLSK) gained 23%, and Hut 8 Corp. (HUT) rose 11%. These increases reflect growing optimism about Bitcoin’s future and the potential for regulatory changes following Trump’s election win.

Trump’s Pro-Crypto Stance and Impact on Regulation

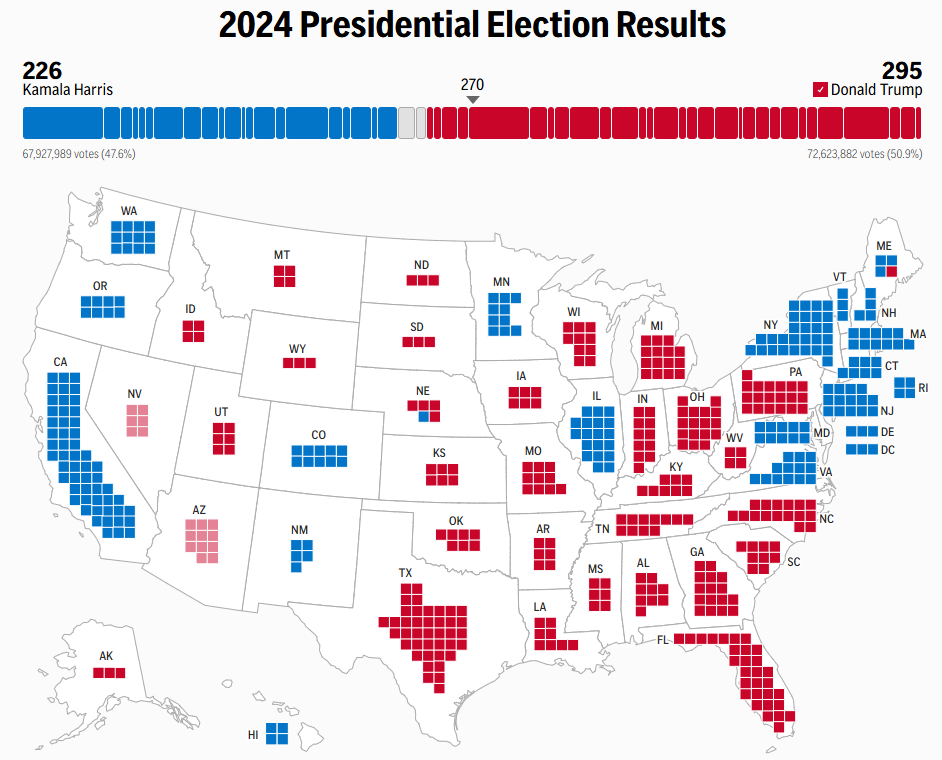

Trump’s victory has fueled optimism in the crypto space, as he ran on a pro-crypto platform.

With Trump likely to secure 312 Electoral College votes and Republicans making gains in both the Senate and House, there’s speculation that crypto-friendly legislation could gain traction. This could lead to favorable regulatory changes for the crypto industry.

Potential for Crypto Legislation

One key piece of legislation is the Financial Innovation and Technology for the 21st Century Act (FIT21). This bill would shift regulatory control over crypto to the Commodity Futures Trading Commission (CFTC) and has already passed the House. With a Republican-majority Senate in January, this bill could be revived.

Another potential bill, the GOP-backed stablecoin regulatory framework, could also move forward with a Republican-led government.

Bitcoin’s Record-High Price Fuels Investor Confidence

Bitcoin’s recent all-time high has further fueled optimism in the crypto market. As Bitcoin continues to reach new price milestones, investor interest—both retail and institutional—continues to grow, boosting stock prices for crypto-related companies.

Currently Bitcoin was trading at $ 74,530.16 as per Coinpedia Markets data.

For a deeper dive into Bitcoin Price Prediction and market trends, check out our detailed analysis.

The Future of Bitcoin and Crypto Stocks

With Trump’s election and the potential for pro-crypto legislation, investor confidence in Bitcoin and related stocks is on the rise. While the market remains volatile, the current momentum suggests continued growth for both Bitcoin’s price and the companies involved in crypto.

Also Read

MicroStrategy, Tesla, and Crypto Stocks See Major Gains Following Trump’s 2024 Victory

Ripple Prediction for the Next 3-9 Months: XRP ETF Launch and SEC Settlement May Spark Market Rally

Bitcoin Price Prediction : Here’s When BTC Price Expected To Hit $150k

Could a Bitcoin Reserve Change America’s Economic Future?

Bitcoin Could Reach $130K to $150K, Says Peter Brandt

Any Feedback?

Get in touch with us here