BlackRock's spot Bitcoin exchange-traded fund (ETF) has made headlines with $872 million in inflows on October 30. This marks the highest inflow day since its launch in January 2023, signaling growing interest in Bitcoin as an investment.

Key Highlights of BlackRock’s Inflows

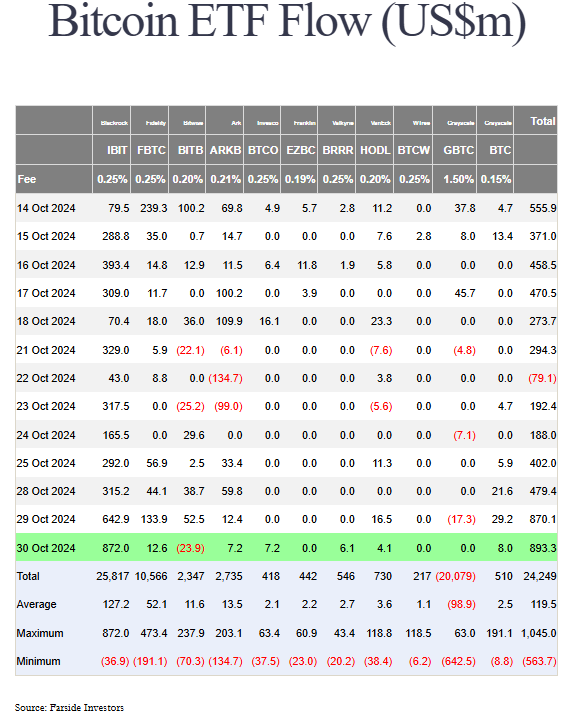

On October 30, BlackRock's ETF (IBIT) recorded $872 million in inflows, surpassing its previous record of $849 million from March 12, according to CoinGlass data. This achievement marks the thirteenth consecutive day of inflows, totaling around $4.08 billion during this period.

Crypto traders speculate that a billion-dollar inflow day may be imminent.

"I said billion-dollar inflows, it was NOT a joke," tweeted trader Trading Axe.

Bitcoin Market Overview

Total inflows across all US-listed spot Bitcoin ETFs on October 30 reached $896.30 million. BlackRock’s IBIT outpaced others, which brought in just $21.3 million. The Fidelity Wise Origin Bitcoin Fund (FBTC) was second with $12.6 million, while Bitwise Bitcoin ETF (BITB) saw outflows of $23.9 million.

Currently, Bitcoin is trading at $72,410, just 1.7% below its all-time high of $73,679 from March 13 as per Coinpedia markets data. This price action shows that investors are closely watching Bitcoin's movement, especially with significant events ahead.

For a deeper dive into Bitcoin Price Prediction and market trends, check out our detailed analysis.

Upcoming Catalysts: US Presidential Election

Analysts believe the upcoming US presidential election on November 5 could be a catalyst for Bitcoin to surpass its previous all-time high. Swyftx analyst Pav Hundal noted that a potential Donald Trump victory might provide a boost to market sentiment.

Increasing Interest in Bitcoin ETFs

On October 29, IBIT's daily trading volume peaked at $3.35 billion, the highest since April 1. Bloomberg ETF analyst Eric Balchunas remarked that this surge in volume reflects the "FOMO" (fear of missing out) among market participants. The excitement around Bitcoin and the broader cryptocurrency market suggests a vibrant future for digital assets.

What’s Next for Bitcoin?

With record inflows and a pivotal election approaching, the Bitcoin market is poised for exciting developments. Investors are focused on the Bitcoin price and its trajectory in the coming weeks. As the landscape evolves, the impact of BlackRock's ETF and market trends will be crucial in shaping Bitcoin's future.

Also Read

Solana News: Canary Capital Files for New ETF, What’s Next for SOL Price?

Bitcoin Price Prediction: How High Might BTC Reach by Year-End?

Will Bitcoin Price Hit $100K in Next 30-Days?

Reddit Sold Major Crypto In Q3; Misses Out On Bitcoin’s Uptober Gains

Any Feedback?

Get in touch with us here