Dear Readers,

As tensions between the US and China continue to impact global trade, both Bitcoin and altcoins are showing sudden pump-and-dump behavior. In the middle of this uncertainty, the latest US Producer Price Index (PPI) data has just been released—giving investors new clues about inflation and economic direction.

What the New PPI Data Shows

The recently announced data provides a snapshot of inflation from the producer side. Here's a breakdown of the figures:

Producer Price Index (Month-over-Month):

Actual: -0.4% | Expected: 0.2% | Previous: 0.1%Producer Price Index (Year-over-Year):

Actual: 2.7% | Expected: 3.3% | Previous: 3.2%

Bitcoin Reacts to the PPI Data

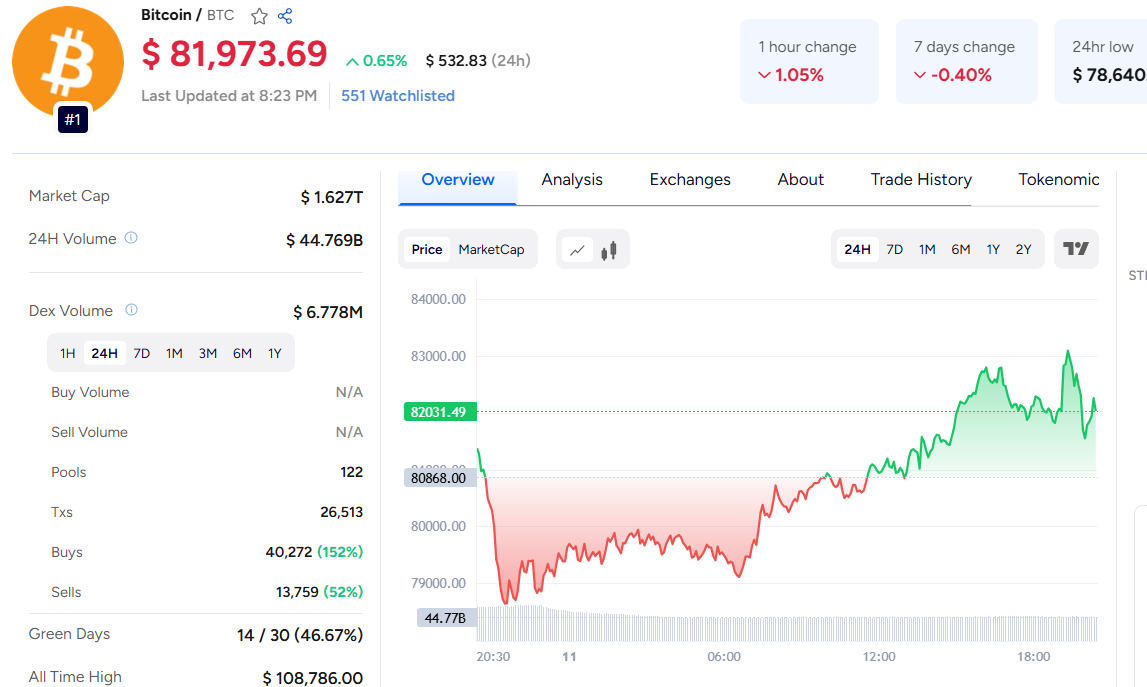

Shortly after the PPI data was released, Bitcoin responded with noticeable price movement. The market seems to be closely watching inflation trends and adjusting to new data quickly. The cooling inflation figures, especially with month-over-month prices declining, give some hope to investors that the Fed may adopt a softer stance on rate hikes.

Currently Bitcoin Price trading at $81,973.69 as per Coinpedia Market data.

For a more detailed Bitcoin price prediction 2030, check out our full analysis!

CPI Data Also Signals Cooling Inflation

Along with the PPI, Consumer Price Index (CPI) data from March also shows a slowdown. The Bureau of Labor Statistics reported:

Year-over-Year CPI:

2.4% in March vs. 2.8% in February; below the expected 2.6%Month-over-Month CPI:

-0.1%, the first monthly decline since May 2020

These figures reinforce the view that inflation pressures are easing, which could influence monetary policy decisions in the coming months.

Tariff Moves Between US, China, and the EU

Adding to market volatility, recent tariff changes have complicated the outlook. Former President Trump first reduced broad tariffs to 10% and announced a 90-day pause. However, he later raised tariffs on Chinese imports to 125%.

In response, European Commission President Ursula von der Leyen matched Trump's temporary pause on April 10. Still, she warned that the EU would consider retaliatory measures if trade talks broke down

Final Thoughts

With inflation data cooling and trade tensions flaring, markets—especially crypto—remain highly sensitive. Investors are hoping for stabilization soon, but for now, volatility continues to rule the day.

Also Read

Trump’s Tariff Policies Weaken US Dollar as Bitcoin Surges Past $82K

Shiba Inu: Shibarium’s Daily Volume Crashes to Just $21K as Rivals Polygon & Base Soar!

Japan’s Crypto Regulations Update: New Rules for Bitcoin, Ethereum & Utility Tokens

FTX’s Bankman-Fried Moved to Violent California Prison ‘Victimville’

Fed’s QT Could Delay Major ETH Rally Until 2025, Warns Analyst

Grayscale’s New Altcoin Watchlist Reveals Top Crypto Investment Picks for Q2 2025

Gold Price Hits Record $3,200 High, Bitcoin Climbs – Trump’s Trade War to Blame?

Will Pi Coin’s Token Burn Strategy Revive the Price to $3?

China Hits Trump with 125% Tariff on U.S. Goods as Trade War Deepens

Any Feedback?

Get in touch with us here