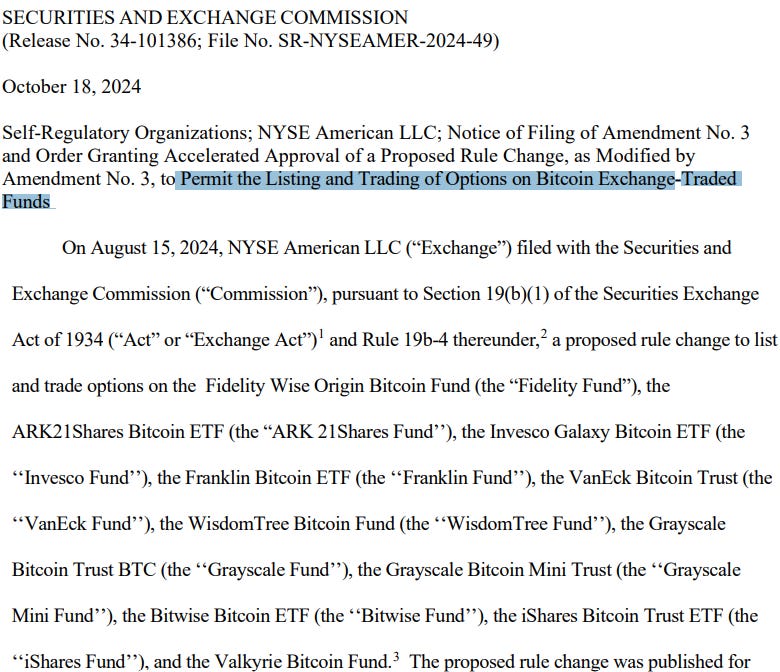

On October 18, the United States Securities and Exchange Commission (SEC) approved applications from the New York Stock Exchange (NYSE) and the Chicago Board Options Exchange (CBOE) to list options for Bitcoin exchange-traded funds (ETFs). This decision is expected to enhance liquidity in Bitcoin markets, potentially driving price movements.

Source: Securities and Exchange Commission

Key Players in Bitcoin ETF Options

The SEC's approval allows options trading for 11 Bitcoin ETF providers on the NYSE, including:

Fidelity Wise Origin Bitcoin Fund

ARK21Shares Bitcoin ETF

Invesco Galaxy Bitcoin ETF

Franklin Bitcoin ETF

VanEck Bitcoin Trust

WisdomTree's Bitcoin Fund

Grayscale's Bitcoin Trust

BlackRock's iShares Bitcoin Trust ETF

Valkyrie Bitcoin Fund

The CBOE also plans to list options for these Bitcoin ETF providers, marking a significant regulatory shift.

Potential Market Impact

Traders are optimistic about how these options will affect Bitcoin markets. Many believe the introduction of options will enhance liquidity, serving as a catalyst for price increases.

As of writing this article bitcoin was trading at $ 68,364.97 with 0.89% increase in last 24 Hours as per Coinpedia Markets data.

For a detailed analysis of Bitcoin price prediction and market implications, check out our in-depth article.

Jeff Park, an executive at Bitwise, emphasized that this approval is a substantial improvement over platforms like LedgerX and Deribit, which lack central guarantors. He noted that options could lead to situations where over-leveraged short traders are forced to buy Bitcoin to cover their positions, potentially triggering a "short squeeze."

The Elephant Analogy

Park illustrated this with an analogy:

"Saying you can't short squeeze a trillion-dollar asset is like saying you can't make an elephant dance. Sure, it's huge, but if you tie enough ropes to its legs and pull hard enough, even the biggest creature can be moved."

Reducing Volatility

Tom Dunleavy, managing partner of MV Global, noted that the introduction of options could help reduce Bitcoin's volatility. By providing a more stable trading environment, options could lead to smoother market movements.

The SEC's approval of options for Bitcoin ETFs is a crucial development for the cryptocurrency market. As traders anticipate increased liquidity and potential price movements, the impact of these changes will be closely watched.

Also Read

SEC Gives Green Light for Bitcoin ETF Options – What’s Next?

Elon Musk Spicing Up Dogecoin Rally, Will DOGE Momentum Continue?

Solana Aims for $190 Mark, Here’s What Traders Should Watch

Any Feedback?

Get in touch with us here