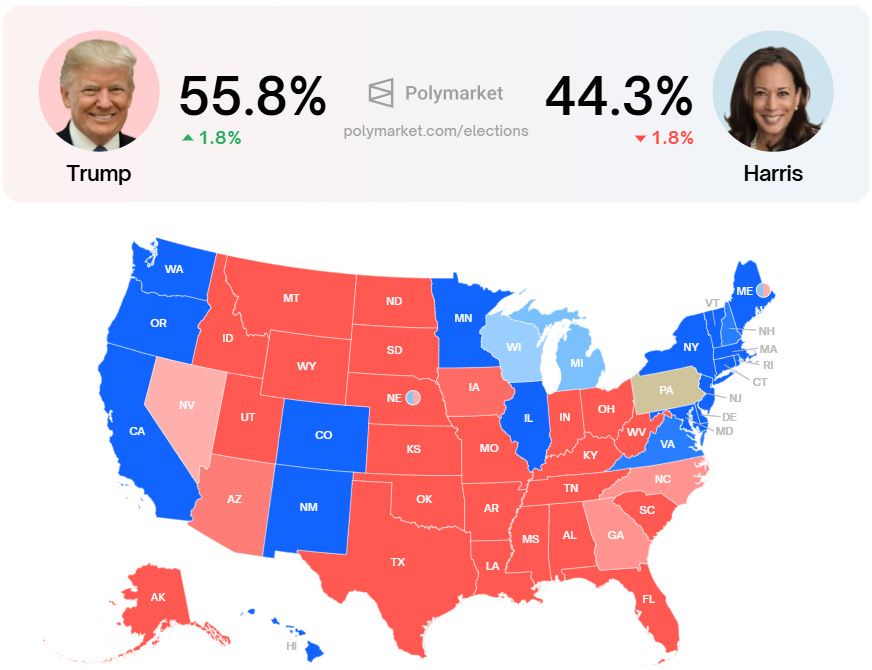

November has begun, and we are in a crucial election week. The markets are showing signs of stress, influenced by cautious central banks and falling inflation rates. Investors are feeling anxious about the U.S. presidential election results and the Federal Reserve's decisions on interest rates. A risk gauge from Bank of America has reached its highest level since the financial crisis, signaling growing concern.

Economic Growth and Inflation Issues

Recent reports indicate that the U.S. economy is growing steadily. However, inflation is higher than expected, complicating the outlook. This mix of factors is leaving investors on edge as they try to predict what might happen next.

Why Is Bitcoin Rising?

Several key factors are driving the recent rise in Bitcoin.

Political Change on the Horizon

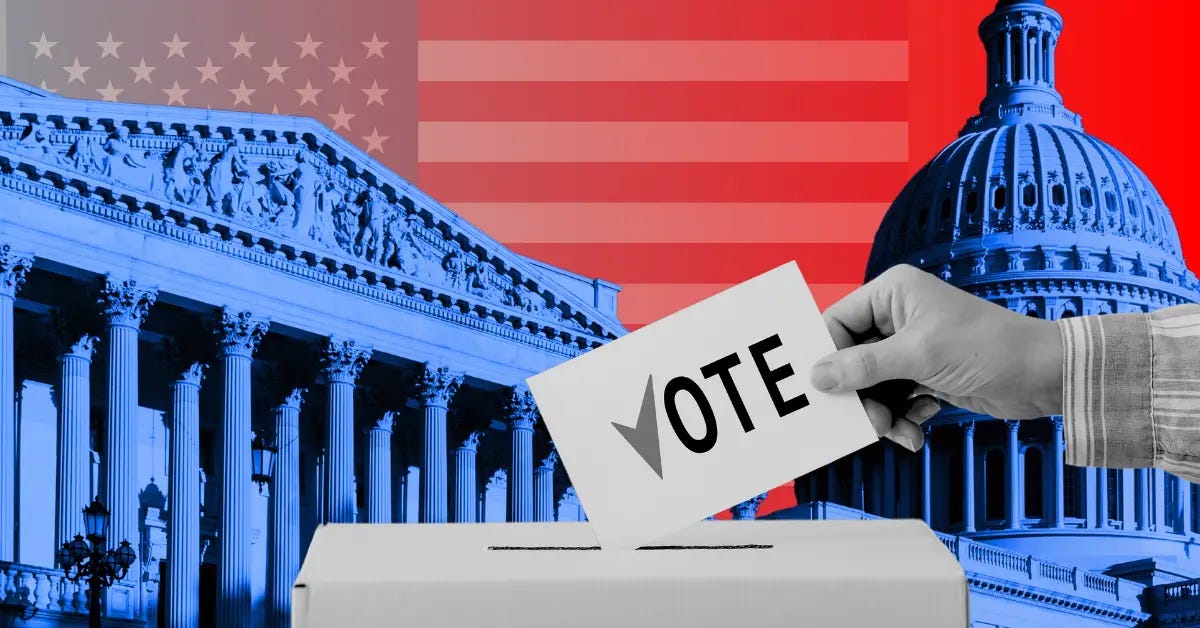

One significant reason is the upcoming U.S. election. The current administration has not been very supportive of cryptocurrencies. If there is a change in leadership, it could create a more favorable environment for digital assets. Predictions suggest that a Trump victory is likely, which could boost Bitcoin prices due to his more favorable stance on cryptocurrencies.

Current Market Performance

Currently, Bitcoin (BTC) and other major cryptocurrencies are gaining attention. Bitcoin Price is trading around $69,000 as per Coinpedia markets data.

For a deeper dive into Bitcoin Price Prediction and market trends, check out our detailed analysis.

While other Altcoins Ethereum (ETH), Solana (SOL), and XRP have all increased by about 1%. Newer coins like Goatseus Maximus (GOAT) and MAGA (TRUMP) have surged nearly 25%.

The total global cryptocurrency market cap has risen by about 0.89%, reaching $2.3 trillion. Total market volume has also jumped significantly, rising 53% to $75.4 billion.

Upcoming Federal Reserve Meeting

Traders are looking forward to the Federal Open Market Committee (FOMC) meeting on Thursday. Many hope for a 25 basis point cut in interest rates. If this occurs, it could lead to a substantial increase in Bitcoin and other cryptocurrencies.

However, recent economic data has raised concerns. A weak job report for October showed lower job growth, with the unemployment rate remaining unchanged. This has sparked speculation about two possible rate cuts this year—one next week and another in December.

With political uncertainty, economic challenges, and upcoming decisions from the Federal Reserve, the cryptocurrency market may face volatility. It’s important for investors to stay informed about these developments.

Also Read

Crypto Market News : Will Fed Cuts and U.S. Election Delay Altseason?

US Election 2024 :Trump Faces Challenge on Polymarket as Harris Closes In

WIF at Risk of Crash? Dogwifhat Support Collapse

Any Feedback?

Get in touch with us here