Bitcoin has hit a new all-time high, surpassing $75,000 for the first time since March 2024. This surge comes amid early U.S. election results showing Donald Trump in the lead, sparking heightened interest in the cryptocurrency market.

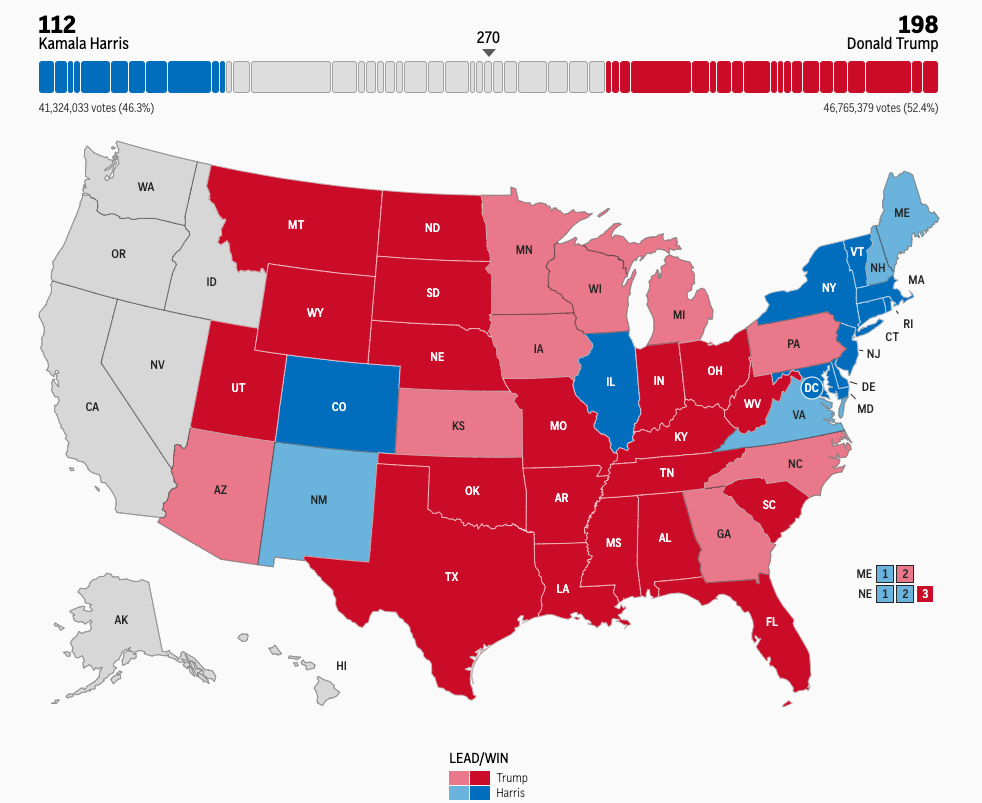

Trump led Harris in early results. Source: AP News

Bitcoin’s Price Surge

On November 6, 2024, Bitcoin (BTC) broke past $73,800, briefly hitting $75,000 as per Coinpedia Markets data. This surge came after early election results indicated that Trump was leading, with 198 electoral votes to Kamala Harris’ 112. The market reacted strongly, with Bitcoin rising more than 3% as traders bet on the impact of these results.

For a deeper dive into Bitcoin Price Prediction and market trends, check out our detailed analysis.

Trump’s Election Lead and Bitcoin’s Rally

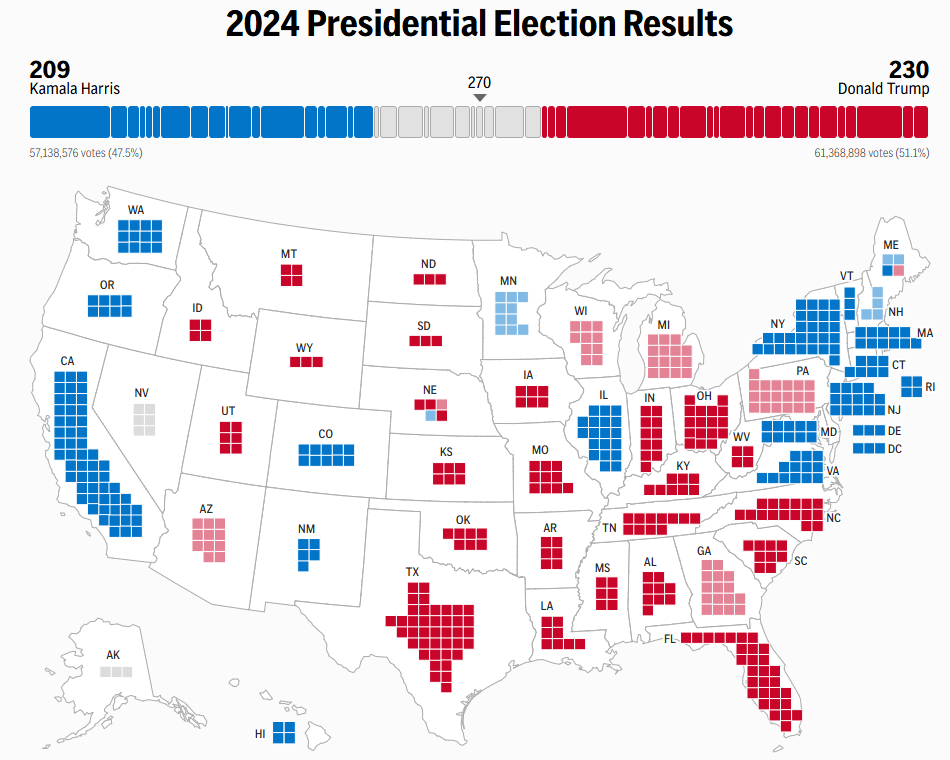

Current Odds. Source: AP News

Bitcoin’s price seems closely tied to Trump’s rising chances of winning the election. On November 5, Bitcoin rallied above $70,000 as Trump’s predicted victory odds rose above 60%. This correlation is also seen on decentralized prediction markets like Polymarket, where Trump’s odds surged while Harris’ chances dropped.

What’s Next for Bitcoin’s Price?

Bitcoin’s price remains volatile, with many traders expecting fluctuations throughout the election period. As of November 6, Bitcoin was trading at $74,339, up 7.2% in 24 hours. Traders are optimistic about Bitcoin’s future, especially if Trump wins, given his more crypto-friendly stance. However, market volatility is likely to continue as the election results unfold.

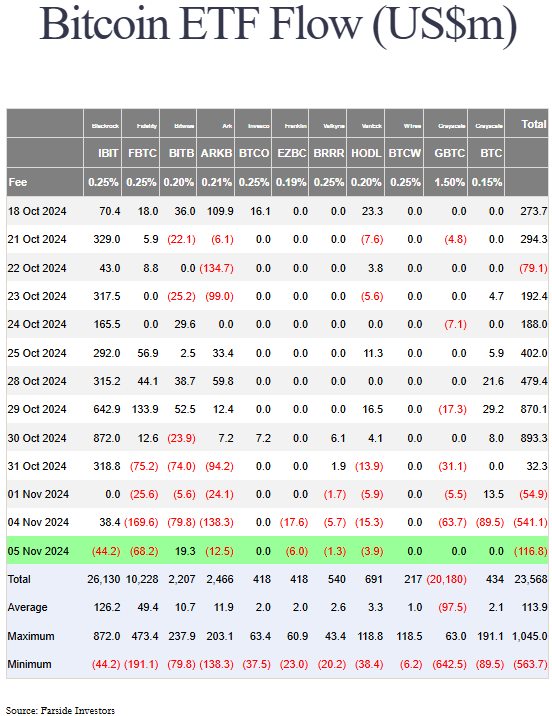

Impact of Bitcoin ETFs and Market Moves

Along with Bitcoin’s price surge, the market has seen significant shifts in Bitcoin ETF flows. On November 4, Bitcoin ETFs saw $541.1 million in outflows, with major firms like Fidelity, ArkInvest, and Grayscale selling, while BlackRock’s IBIT saw $38.3 million in inflows. This shows that investors are reacting to Bitcoin’s price movements and the broader market uncertainty.

Traders in the options market are also hedging their positions, with most bets placed on higher prices between $72,000 and $75,000. However, some are buying put options at $64,000, indicating concern over potential downside risks.

Continued Volatility After the Election

Bitcoin’s volatility is expected to persist after the election. While the recent price surge is significant, market participants are bracing for further fluctuations depending on the election results and any regulatory changes.

What’s Driving Bitcoin’s Price?

Bitcoin’s recent surge above $75,000 reflects its sensitivity to global events, especially U.S. elections. The rising chances of a Trump victory are driving optimism in the market. However, Bitcoin’s price will likely remain volatile in the coming weeks, depending on political developments and market sentiment.

Also Read

Pro-XRP Lawyer John Deaton Loses Senate Race; Crypto Fans Push Trump to Nominate Him for SEC Chair

1.38 Billion XRP Tokens Move From Exchange, Election Fever or What?

Big Breaking: Bitcoin Hits Fresh ATH, Nears $75K Mark as Trump Gains Early Leads in Key States

US Election Results : Elizabeth Warren Wins Her Third Senate Term

Bitcoin (BTC) Price Hits All Time High, Dogecoin Soars 16%, Crypto Market Gains $2.5 Trillion

Any Feedback?

Get in touch with us here