Why Bitcoin(BTC) Price Crashed 7% After Hitting New Yearly Highs of $63.9K

What Next For BTC Price?

Bitcoin, the leading cryptocurrency, took investors on a wild ride this Wednesday, with a rapid 7% drop from its peak of $64,000. Earlier in the day, it had surged above $60,000 for the first time since November 2021, only to quickly fall back to $59,400, creating a volatile market environment for traders.

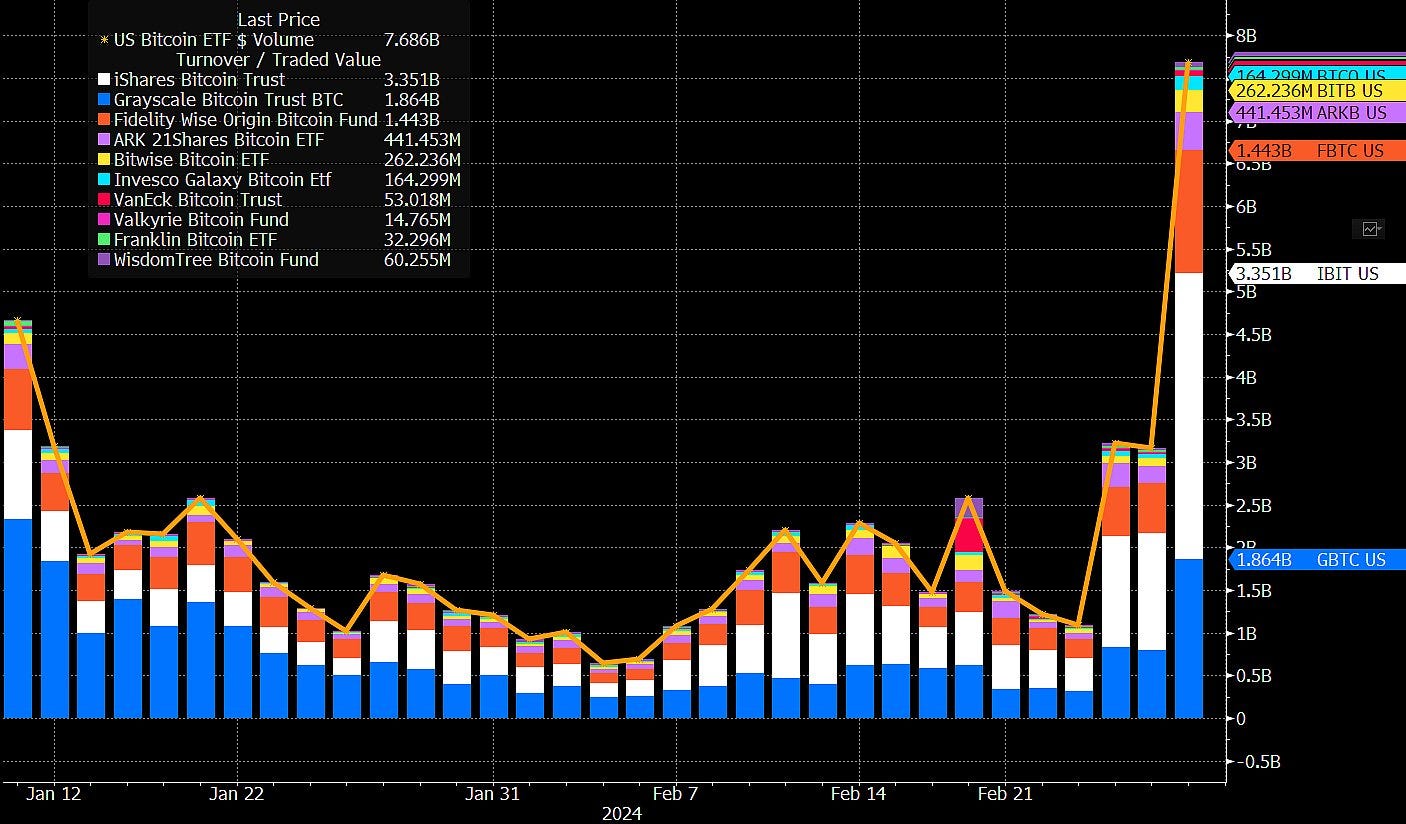

Trading volumes for the ten new U.S. Bitcoin ETFs reached a historic high, more than doubling their previous record set just days ago.

The United States spot Bitcoin (BTC) exchange-traded funds (ETFs) saw a remarkable increase in trading volumes, surpassing the previous record by over one and a half times.

On February 28, these ten ETFs recorded a combined volume of $7.69 billion, according to data from X reported by Bloomberg ETF analyst James Seyffart.

This figure exceeded the previous record of $4.66 billion, which was set on the day of the fund's launch on January 11.

BlackRock’s iShares Bitcoin ETF (IBIT) accounted for 43.5% of the total volume, reaching $3.35 billion and doubling its previous daily record.

This volume also represents approximately double the trading volume of all ten ETFs combined on the preceding day, February 27.

Reason’s for Price Surge

Bitcoin's recent surge, driven by a 42% rise in February, was boosted by the approval of U.S. Bitcoin ETFs. Major institutions like Grayscale and BlackRock have seen increased trading activity, indicating rising interest in cryptocurrency. Additionally, factors like the upcoming Bitcoin halving and expected U.S. Fed rate cuts contributed to Bitcoin's climb to $64,000.

Factors Behind Sudden Decline in Price

Bitcoin faced a sudden 7% plunge due to various factors.

Digital assets incurred losses totaling $700 million within 24 hours.

Market turmoil spread to other cryptocurrencies like ETH, SOL, XRP, ADA, DOGE, and AVAX.

The CoinDesk 20 Index dropped nearly 5% after hitting an all-time high.

$700 million in liquidations across digital assets contributed to the sell-off.

Massive liquidations led to closure of leveraged derivatives trading positions.

Similar to a significant wipe-out in August, when Bitcoin plummeted to $25,000, liquidating $1 billion.

U.S.-listed spot Bitcoin ETFs saw record trading volumes, with BlackRock's IBIT alone trading $3.3 billion in shares.

Discover more about the recent cryptocurrency market turmoil and its implications on Coinpedia's website. Explore in-depth analysis and insights now!

Price Prediction

Bitcoin Price Prediction 2024-2030: Will BTC Price Cross The $100K Milestone Post-Halving?

Ethereum Price Prediction 2024, 2025: Will ETH Price Cross The $3,000 This Year?

Dogecoin Price Prediction 2024 – 2025: Will DOGE Prices Top $1 With This Break?

Solana Price Prediction 2024 – 2030: A New Surge as SOL Eyes $500!

Any Feedback?

Get in touch with us here