Mt. Gox, the bankrupt cryptocurrency exchange, recently transferred 32,371 BTC, valued at approximately $2.2 billion USD, to unmarked wallet addresses.

This transfer has raised questions about its impact on the Bitcoin price and market stability. At the same time, broader concerns—such as the U.S. presidential election and Federal Reserve interest rate decisions—are adding uncertainty for investors.

Mt. Gox Bitcoin Transfer: What Happened?

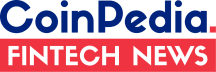

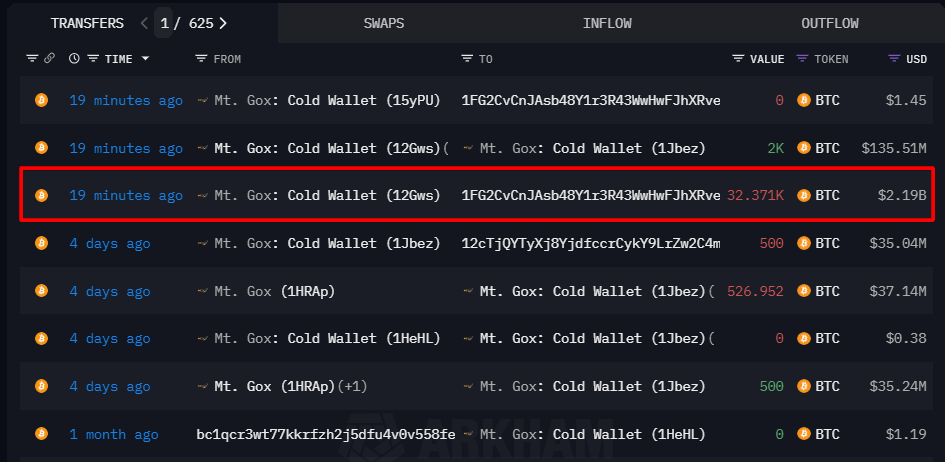

On Monday, Mt. Gox moved 32,371 BTC in two transactions to unidentified wallets. According to blockchain firm Arkham, 30,371 BTC went to "1FG2C…Rveoy" and 2,000 BTC to "1Jbez…LAPs6." This is part of Mt. Gox's effort to repay creditors following its collapse.

While the transfer may not immediately affect the Bitcoin price USD, it signals the ongoing asset reorganization as part of creditor repayments. Investors are watching closely for any market impact.

Preparing for Creditor Repayments?

The large transfer suggests Mt. Gox is preparing for more substantial creditor payouts. Last week, the exchange moved 500 BTC, but this latest transfer is much larger. Additionally, 2,000 BTC were moved between Mt. Gox's cold wallets, which could indicate further preparations for liquidation.

If creditors begin to sell their Bitcoin holdings, it could cause short-term volatility in the price of Bitcoin. However, once the repayment process concludes, it could bring stability to the market.

Market Concerns and U.S. Election Impact on Bitcoin Price

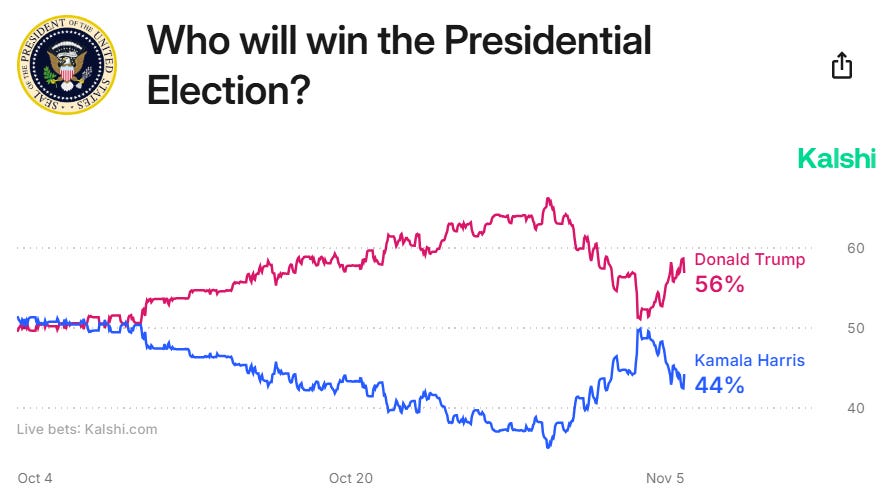

In addition to Mt. Gox's activity, the broader market is facing growing uncertainty due to the upcoming U.S. presidential election and potential Federal Reserve interest rate changes. A recent report by Kalshi shows that Donald Trump's odds of winning are rising, surpassing those of Kamala Harris. This political uncertainty is contributing to investor anxiety and affecting market sentiment.

Despite this, Bitcoin remains strong, currently trading around $68,000 as per Coinpedia markets data. However, political and economic instability could influence future price movements.

Bitcoin Price Predictions Amid Market Uncertainty

The combination of Mt. Gox’s large transfer and political and economic uncertainty makes Bitcoin price prediction challenging. Short-term volatility is likely, especially as investors react to potential rate hikes or election outcomes.

While there may be temporary price dips if creditors sell their Bitcoin, Bitcoin's long-term outlook remains positive due to growing institutional adoption and mainstream acceptance.

The Mt. Gox transfer, along with external factors like the U.S. election and the Federal Reserve’s actions, is creating a volatile environment for Bitcoin investors. With Bitcoin currently trading around $68,000, market conditions could shift rapidly depending on political and economic developments.

Stay informed about these key events and market movements to make strategic decisions about your Bitcoin investments. Though the market may be unpredictable, there are still opportunities for those who are prepared.

Also Read

US Election 2024 : Joe Rogan Endorses Trump After Musk Podcast

XRP Lawsuit: Mark Yusko Says New SEC Leadership Could ‘End Ongoing Lawsuits’

Bitcoin Price at Risk? Mt. Gox Shifts Billions in BTC

Bitcoin Price Drops 2% Ahead of 2024 U.S. Election, What To Expect in Next 24hrs ?

Any Feedback?

Get in touch with us here