As of October 29, Bitcoin is trading at $71,561, marking a 4.9% increase in just 24 hours as per Coinpedia Markets data. This price is the highest in nearly five months and puts it only 3.4% away from its all-time high of $73,700, reached in March. Analysts attribute this strength to speculation around Trump’s election prospects and a rebound in Bitcoin’s price amid geopolitical unrest.

For a deeper dive into Bitcoin Price Prediction and market trends, check out our detailed analysis.

Analysts from Bitfinex are optimistic about Bitcoin’s potential to reach a new all-time high following the U.S. presidential election on November 5.

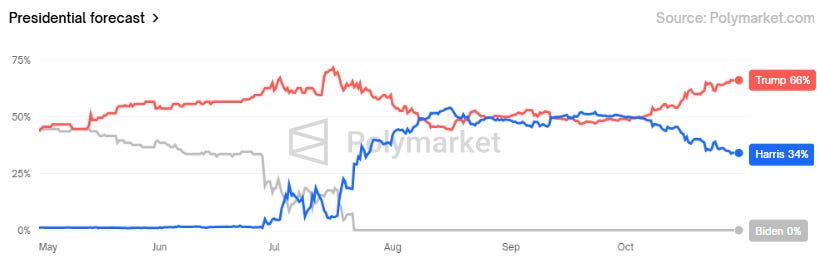

They describe the current market conditions as a "perfect storm" for a significant price surge. With Donald Trump leading in various betting markets and historically favorable conditions for the fourth quarter, the stage is set for an exciting period for Bitcoin investors.

The "Trump Trade" Narrative

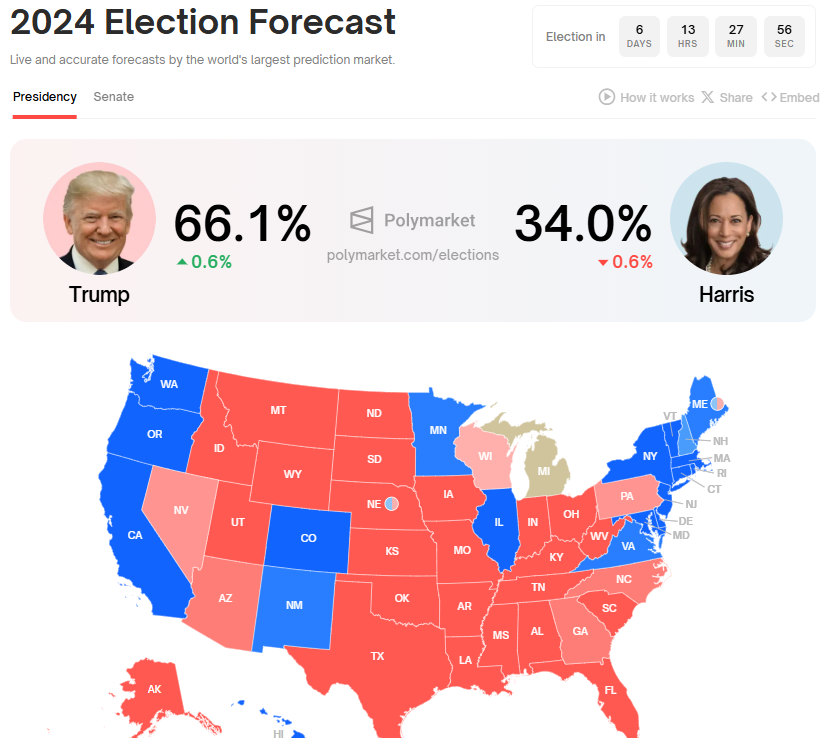

Analysts emphasize the growing “Trump trade” narrative, noting a strong correlation between a potential Trump victory and rising Bitcoin prices. Trump has a substantial lead over Kamala Harris on the betting platform Polymarket, while Harris holds a narrow advantage in national polls. This combination of betting dynamics and polling adds to the excitement surrounding the election and its potential impact on Bitcoin.

Record Open Interest Signals Strong Demand

Bitcoin notched a new ATH open interest of $41.7 billion on Oct. 29. Source: CoinGlass

Bitcoin’s recent price rise is bolstered by record open interest, which reached an all-time high of $41.7 billion as of October 29. This reflects strong demand among investors for leveraged exposure to Bitcoin. Additionally, there’s been a noticeable increase in call options for BTC set for late December, indicating that many traders are positioning for a potential surge after the election.

Looking Ahead

Bitfinex analysts believe the market is gearing up for a "post-election surge" that could push Bitcoin beyond its previous all-time high. With record open interest and a steady build-up of options, investors are clearly optimistic about Bitcoin’s near-term prospects.

Also Read

Dogwifhat (WIF) Could Hit $3, Here’s Why

Ethereum Bull Run Imminent? $3.5 Billion ETH Leaves Exchanges

Bitcoin Set to Hit $72,000, Thanks to Metaplanet’s Strategic Move

Any Feedback?

Get in touch with us here