Bitwise Asset Management has filed its 10 Crypto Index ETF with the U.S. Securities and Exchange Commission (SEC), signaling its intent to launch a major crypto-based ETF. This filing, made in partnership with the New York Stock Exchange (NYSE), marks a significant step in Bitwise’s efforts to tap into the growing crypto ETF market.

The Big Move by Bitwise

Bitwise has officially submitted the 10 Crypto Index ETF to the SEC, with the NYSE filing the necessary paperwork earlier this month. The filing is now under review, and the outcome could significantly impact the cryptocurrency market by allowing mainstream investors to access digital assets via traditional financial markets.

What’s Inside the Bitwise 10 Crypto Index ETF?

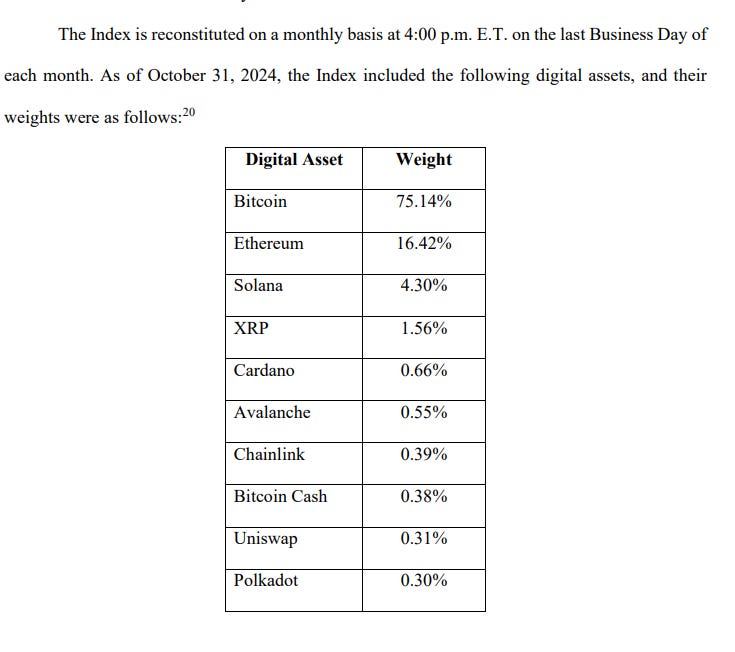

The ETF is designed to track the performance of the top ten cryptocurrencies. These include Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). Here’s how the index breaks down:

Bitcoin (BTC): 75.14% of the index

Ethereum (ETH): 16.42% of the index

Solana (SOL): 4.3% of the index

XRP: 1.56% of the index

Cardano (ADA): 0.66% of the index

Avalanche (AVAX): 0.55% of the index

Chainlink (LINK): 0.39% of the index

Bitcoin Cash (BCH): 0.38% of the index

Polkadot (DOT): 0.30% of the index

Uniswap (UNI): 0.31% of the index

Bitcoin holds the largest share of the fund, followed by Ethereum and Solana. Smaller altcoins make up the rest of the portfolio.

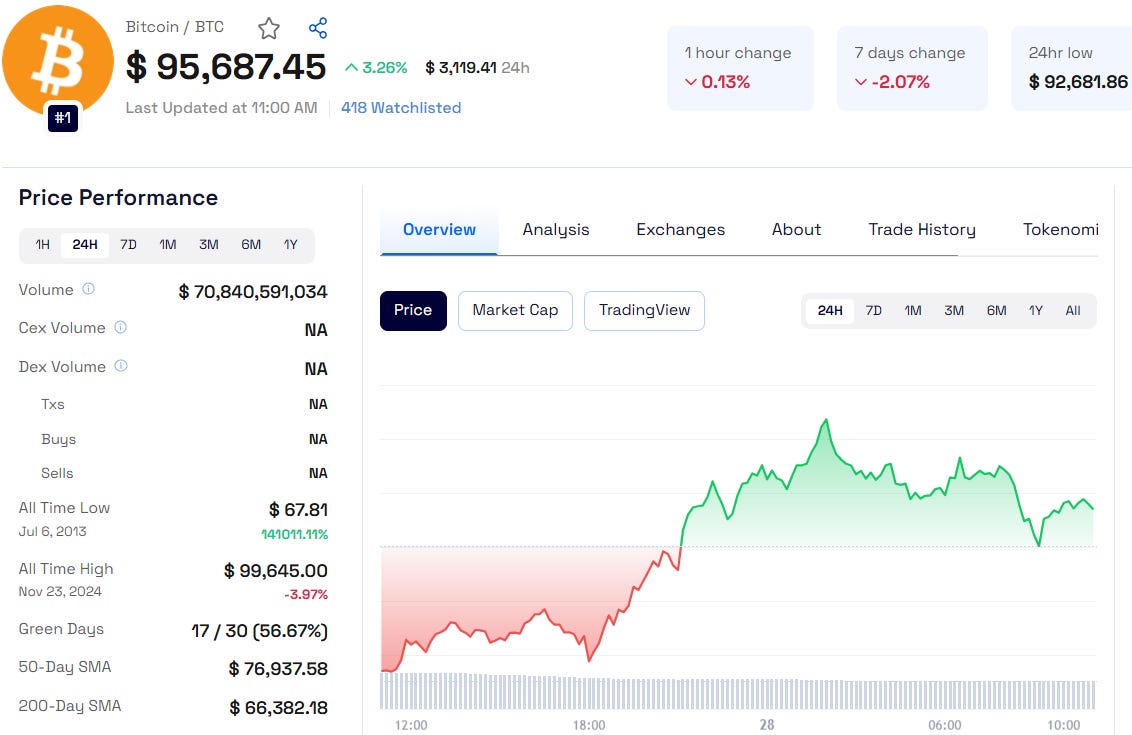

Currently Bitcoin Price trading at $95,687.45 as per Coinpedia Markets data.

For a more detailed Bitcoin Price Prediction 2030 and insights on Bitcoin’s next moves, check out our full analysis.

Fund Custody and Administration

Bitwise has partnered with Coinbase Custody to manage the crypto assets, ensuring security and transparency. The Bank of New York Mellon (BNY Mellon) will oversee the fund's cash holdings, administration, and transfers, adding another layer of trust for potential investors.

Crypto ETF Approval: A Growing Hope

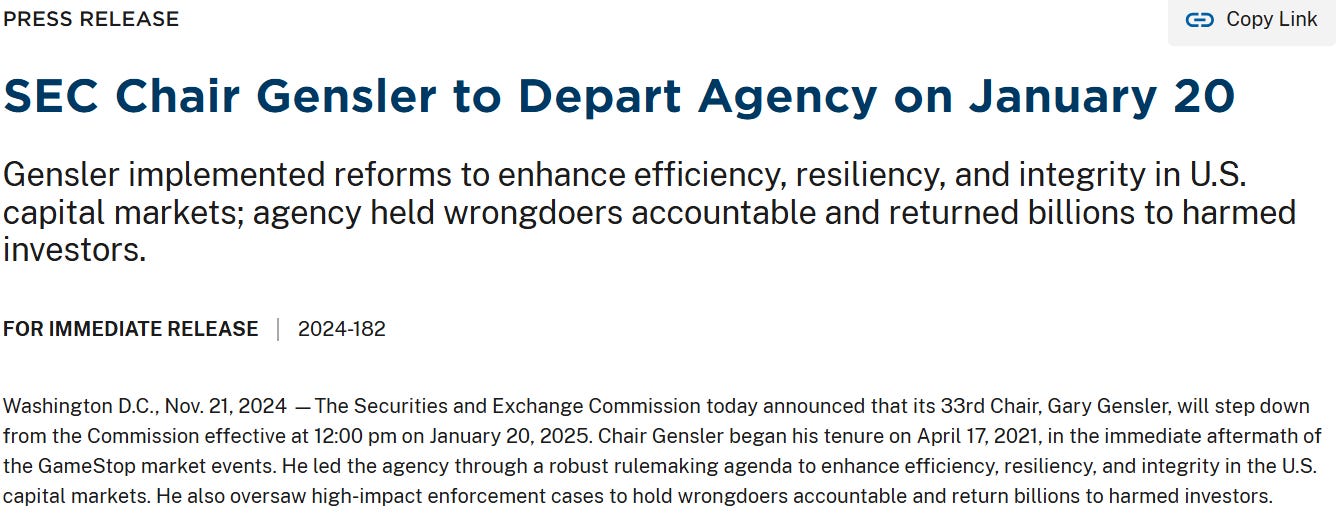

The approval of cryptocurrency ETFs in the U.S. has been slow, with only Bitcoin and Ethereum ETFs getting the green light. However, with the recent resignation of SEC Chair Gary Gensler, industry experts are hopeful that the regulatory landscape will become more favorable for crypto products.

Bitwise is looking to capitalize on this shift, with other ETF filings focused on Bitcoin, Ethereum, and Solana.

The Countdown for Approval

As the SEC reviews Bitwise’s filings, the crypto community is eager for a decision. The approval of the 10 Crypto Index ETF could pave the way for more crypto ETFs, helping bring cryptocurrency investments to a broader audience.

While the approval process is still uncertain, Bitwise’s filing highlights growing optimism in the crypto space. If approved, the ETF could offer a simpler, more regulated way for investors to access digital assets.

Final Thoughts

Bitwise’s 10 Crypto Index ETF filing could be a turning point in the cryptocurrency market. If approved, it will provide an easier route for investors to diversify their crypto holdings. The coming months will be critical in determining whether crypto ETFs become more widely accepted.

Also Read

Why is Bitcoin Price not Crashing Today?

Cardano Price Prediction For November 28

XRP Price Prediction For November 28

XRP Price Set to Explode? Whale Moves $36.67M in Tokens

Trump’s Team Picks Paul Atkins for SEC Chair: Report

Any Feedback?

Get in touch with us here