XRP futures have launched on CME Group’s derivatives platform, recording $1.5 million in trading volume on day one — a notable step for the token.

A Solid Start

Early CME data shows:

4 standard contracts (50,000 XRP each) traded, totaling about $480,000 at an average price of $2.40.

106 micro contracts (2,500 XRP each) traded, adding over $1 million in volume.

Though modest, the launch highlights growing institutional interest in XRP.

Currently XRP Price trading at $2.39 as per Coinpedia Market data.

Contract Details

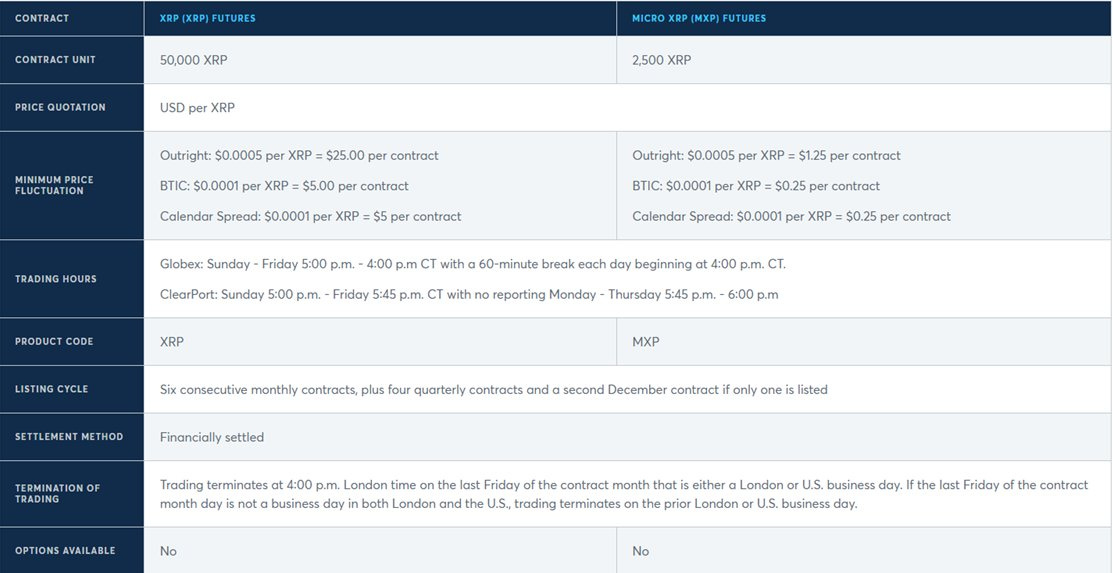

These futures are cash-settled, tied to the CME CF XRP-Dollar Reference Rate, published daily at 4:00 P.M. London time.

With both standard and micro contracts, CME offers flexibility for institutional and retail traders alike.

Regulatory Green Light

The launch follows the CFTC’s classification of XRP as a commodity, allowing CME to list regulated futures.

Ripple CEO Reacts

Ripple CEO Brad Garlinghouse called it a “key institutional milestone for XRP” on social media. He also noted that Hidden Road executed the first block trade.

Spot ETF Could Be Next

The launch may boost the case for a spot XRP ETF. Nate Geraci, ETF Store president, said it's “only a matter of time.”

"CME-traded XRP futures are live... Spot XRP ETFs only a matter of time," he posted.

What This Means for XRP

While the initial trading volumes are still small compared to Bitcoin and Ethereum futures, XRP’s presence on CME opens up new opportunities. It improves price discovery and could have a similar market impact as BTC and ETH futures when U.S. markets open.

This launch may be modest, but it’s a significant step toward broader institutional adoption of XRP.

Also Read

XRP Set to Benefit as GENIUS Act Passes Key Senate Vote on Stablecoins

Bithumb Regains Ground in South Korea’s Crypto Market Amid Upbit Dominance

XRP Price Prediction For Crucial Next 72 Hours

Breaking: U.S. Senate Moves GENIUS Act Forward with 66-32 Vote

Any Feedback?

Get in touch with us here